Debunking the 3 Most Common Myths About the 2024 Housing Market

Constantly changing headlines and predictions are already making the 2024 housing market extremely challenging to navigate.

Unfortunately, the number of misconceptions about buying, selling, and owning a home has never been higher. According to Fannie Mae’s most recent Home Purchase Sentiment Index, only 17% of people think it’s a good time to buy a home.

It’s not surprising that the outlook about future housing demand and the stability of home prices is negative as we leave behind a year of decades-high mortgage rates and low demand for homes.

We understand the headlines can sometimes be alarming: “Home sales activity at a decade low.” “Prices are collapsing.” “The market is set to crash.” The attention-grabbing narratives can be confusing to those who are reading that the market is in trouble, yet finding very competitive conditions and price increases when they look at homes.

With so many competing voices vying for your attention – who do you trust?

As mortgage advisors, the biggest part of our job today is dispelling myths that paint housing as a bad investment. While it’s true that buying a home in 2024 will not make financial sense for everyone, we believe that homeownership is still an effective way to build wealth for those who can afford a mortgage payment today and plan on keeping their property for several years.

In this article, we’ll break down the FACTS and DATA about what’s currently going on with supply and demand, what has happened in the past with home prices and interest rates, and how we believe the housing market will change in 2024.

Myth #1: Interest rates are not going to come down.

Let’s look at the history of the Federal Reserve’s economic policy, recessions, and their impact on mortgage rates.

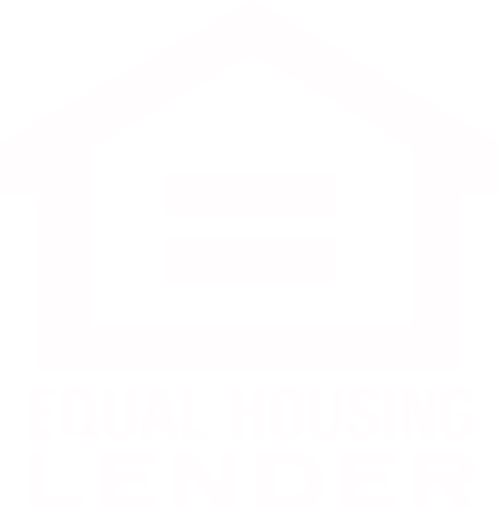

In the early 1980s, tight monetary policy in the United States to control inflation led to a recession. The Fed Funds rate was increased from 11% to 20% to combat the hyperinflation that carried over from the 70s because of the 1973 oil crisis and the 1979 energy crisis.

In the two years leading up to this recession, fixed mortgage rates reached their highest point in modern history at an annual average of 18.6%. However, once inflation calmed down and the recession started, rates fell to 12%.

In 1999, the Federal Reserve began a tightening program to combat inflation caused by the dot-com bubble. This cycle saw the Fed Funds rate rise by 1.75% in just under 12 months, and mortgage rates jump nearly 2%. Inflation fell because of the rate hikes and the 2001 recession, and the market response saw mortgage rates drop lower than they had ever been down to 5.5%.

This brings us to the current monetary tightening cycle. In the last 3 years, we’ve seen inflation jump from 1.75% to 9.1%. Consequently, mortgage rates skyrocketed from a low of 2.5% to a high of over 7% in October 2023.

The Fed has hiked the Fed Funds rate at the fastest pace in history. Luckily, the policymakers currently have a positive outlook on inflation for 2024 and have continued pause any additional rate hikes, keeping the Fed Funds rate steady at a target range of 5.52% to 5.50%.

The Fed’s moves don’t have an impact on mortgage rates directly, but rate cuts usually lower the yield on the 10-year Treasury, which is an indicator mortgage lenders look at when setting their rates. Average mortgage rates have been steadily declining since last year’s highs.

The aggressive monetary policy will eventually bring inflation to the Fed’s target and the economy will slow down as a result, which will bode well for mortgage rates.

Myth #2: Lower mortgage rates will not bring more buyers into the market.

A lot of people think that, even if mortgage rates do come down, nobody is going to buy homes because prices are too high.

Prices of course influence home affordability, but so do interest rates. Rates will come down eventually, and even a small decrease will impact affordability in a meaningful way. For every 0.5% improvement in interest rate, the payment on a median priced home (currently $416,1000) decreases roughly $110.

According to realtor.com, when mortgage rates push 7%, 20 million households are priced out of the market compared to when rates are at 3%. Essentially, this means that for every 1% drop in mortgage rates, 5 million more borrowers are able to afford a mortgage on a median priced home.

To have that same impact on affordability, the value of the median priced home would have to decrease by almost 11%. And there is just no concrete evidence that this is going to happen (more on that below).

Lower prices could also have the opposite effect when it comes to buyer demand. Currently, there are a lot of homeowners who want to move but do not want to give up their low interest rate. If home prices come down before interest rates do, these homeowners will be even more entrenched in their homes because they will not want to sell at a lower price.

Myth #3: Home prices are falling and will continue to fall.

Those who think home prices are falling simply are not paying attention.

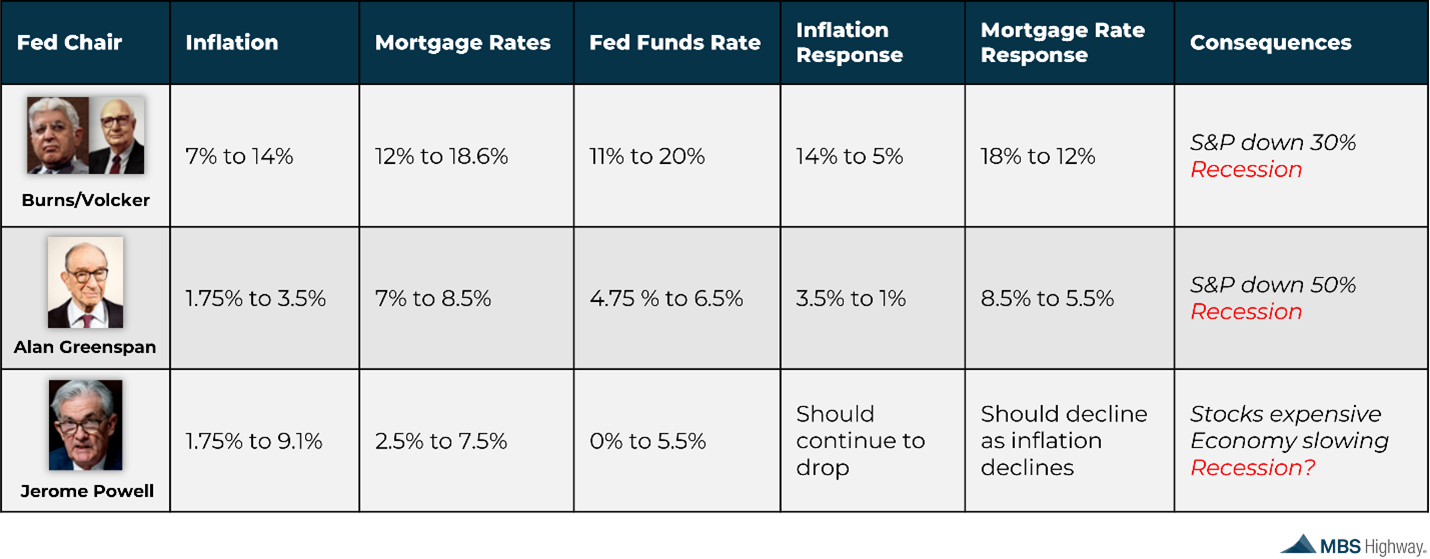

Home prices reversed course in February 2023 and have continued to rise at a steady pace in most areas of the country. All the reputable home price indexes confirm that in many areas of the country, price cooldowns were just mild corrections. Not only that, but many of the new numbers have eclipsed the ones we saw at the peak of the market in June of 2022.

According to Redfin’s November 2023 Home Price Index, prices are up year-over-year in 49 out of the 50 most populous U.S. metro areas that the index follows.

Goldman Sachs housing analysts, who have been consistently bearish on housing over the last few years, also recently changed their tune on the market and no longer think home prices will fall this year.

Their latest housing forecast shows a modest growth in home prices for 2024, with an estimated increase of 0.6%. However, the subsequent years, particularly 2025 and 2026, are expected to witness a more robust rebound, with prices projected to grow by 3.8% and 4.9% respectively. This positive outlook signifies a recovery from the challenges faced by the U.S. housing market in recent times.

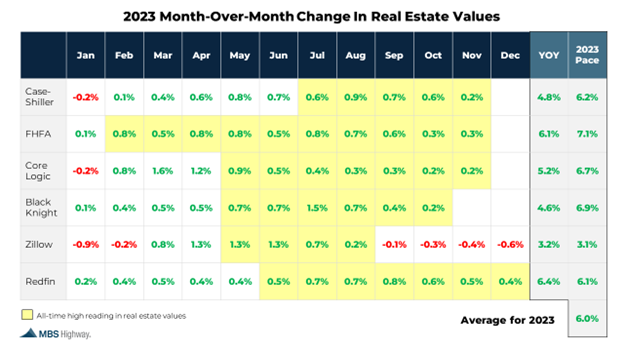

The reason home prices will continue to rise is because there are still not enough homes on the market. According to Black Knight’s December 2023 Mortgage Monitor, the inventory of homes listed for sale improved for a fifth consecutive month in October 2023, but the deficit relative to pre-pandemic listing levels is still at -42%.

Realtor.com’s December 2023 data draws the same conclusion. While we are still seeing a small amount of month-over-month growth in active listings (a spike happens every year around this time), the growth rate is declining as sellers continue to list fewer homes than last year and buyers compete over the remaining affordable homes for sale.

As you can see below, while inventory has slightly increased since the start of 2023, levels are still drastically lower than pre-pandemic.

The Bottom Line

Home prices are determined by two things: supply and demand. Yes, there are few buyers in an inflation-heavy economy with high interest rates, but for home prices to go down there needs to be fewer buyers than sellers – and that is just not within the realm of possibility today.

There is a lot of pent-up demand in the housing market right now that has been kept at bay because of the affordability problem. But as affordability improves, we are going to continue to see more people move forward with their homebuying plans.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”