Why Aren't Home Prices Falling as Inventory Rises?

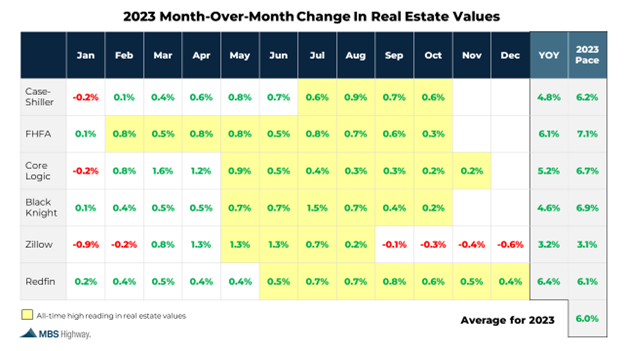

2024 is shaping up to be a year of solid home appreciation following the numbers that are coming in from last year.

Recent reports from CoreLogic and Redfin confirm that home prices rose in 2023 despite rough homebuying conditions. Not only that, but the 2023 numbers eclipsed the ones we saw at the peak of the market in June of 2022.

Even the Zillow Home Value Index, which is usually the most conservative measure of the popular home price indexes, is showing 3.2% positive home appreciation in 2023.

Why the Housing Market Will Continue to Surge

Housing inventory and new listing data are all rising, but the price cut percentages are falling. This is because there is still a shortage of sellers willing to list their homes, even though mortgage rates have fallen recently.

Zillow’s December 2023 Market Report, fewer new listings are hitting the market, which is typical for this time of year. Nationally, new listings fell 30.2% from November. There were fewer new listings than last December in all 30 of the 50 largest markets.

However, new listings are now up 2.1% compared to the year prior. A deficit of 14.5% compared to pre-pandemic norms is vastly improved from a trough of 35% in April.

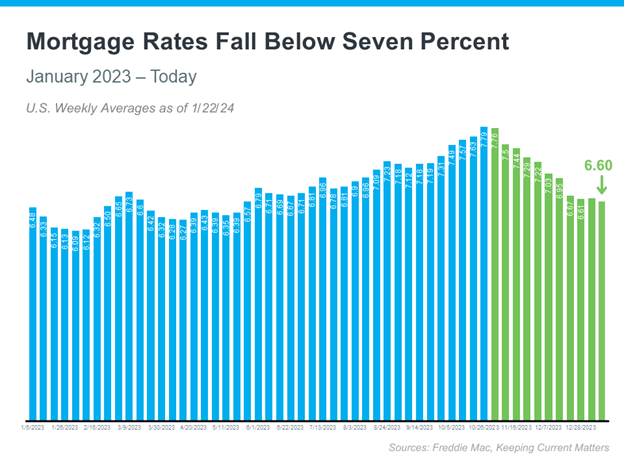

The driving force behind the inventory shortage continues to be mortgage rates. Even though they have improved recently (more on that below), they remain much higher than pre-pandemic levels. The bond markets that determine mortgage rates are still reacting to recent Federal Reserve news that more hikes to the Fed Funds rate are likely coming in the near future, as well as economic data reports that show the economy is not slowing down as quickly as anticipated.

Mortgage Rates See Improvement As Inflation Outlook Improves

Housing inventory and mortgage rates are closely connected, as the record-low home inventory comes largely due to sellers feeling trapped by their low mortgage rates.

While mortgage rates are still much higher than all of us would like, they did improve fairly significantly recently following the release of the December Personal Consumption Expenditures (PCE) price index – another closely watched economic indicator that measures changes in the prices of goods and services purchased by consumers in the United States.

While the public more closely follows the Labor Department’s Consumer Price Index (CPI), the Federal Reserve prefers the PCE because it adjusts for shifts in what consumers actually buy, while the CPI measures prices in the marketplace.

The latest PCE report showed that headline or all-in inflation rose o.17% for the month of December, which was close to the 0.2% expected. The year-over-year reading remains at 2.6%.

The core rate, which the Fed focuses on and strips out food and energy prices, rose 0.17% last month, which was also just beneath expectations. One year-over-year basis, the index fell from 3.2% to 2.9%.

According to MBS Highway, when you annualize the last 8 months, the core PCE reading is only at 2.08%, which is very close to the Fed's target and something they must feel good about.

The markets are seeing this as a positive signal that inflation is moderating, which is helping mortgage rates.

Basically, we are on the right track to lower mortgage rates that actually stick. As rates drop, it will encourage some sellers who have been reluctant to sacrifice their low interest rates to be less wary of putting their homes on the market, which could help the inventory problem. However, increased home affordability will also bring more first-time homebuyers into the market who will not be adding to the number of homes for sale.

What This Means for You

Our advice remains the same: if you are ready to buy a home, schedule a meeting with a mortgage advisor to find out how much you can afford with the current market conditions.

If you can make the numbers work, we still believe the best strategy is to pull the trigger on buying a home you love sooner rather than later. Your mortgage payment might be a bit higher than you would like initially, but you will be able to lock in your housing payment and immediately start building equity through appreciation. Rates will come down like they always do, and you will be able to refinance to a permanently lower housing expense.

If you’re ready to get started, we’d love to help you!

This won’t be an immediate drop to 5% mortgage rates. We will likely see some ups and downs in the months ahead, but the recent economic reports are clear indicators that the trend has reversed from higher and higher mortgage rates to lower rates ahead.

If you are not ready to make a move just yet, here are 3 steps you can take now to prepare for when the time is right:

1. Schedule a meeting with a mortgage advisor (even if you are not ready to buy!)

It’s always best to do this sooner rather than later. No credit check or application needed – we will just discuss your options and put a plan in place so you can move quickly when the time is right.

2. Choose a loan program.

Every mortgage program has unique benefits and different requirements to qualify. If you learn about these now and choose the one that makes sense for you, you will have a solid roadmap for what you need to do to prepare for your purchase.

3. Start improving your finances.

Once we’ve decided on the best mortgage strategy, the rest of the time will be spent here. Get your down payment in order, make sure you have all your income and asset documentation, pay off any debt you need to improve your credit score, and start planning for your new housing payment.

Preparation is key in this market! Starting the process early will make sure you are able to submit an offer on a home right away and lock in a lower rate when the time is right.

If you would like to know exactly what you need to do to prepare for a home purchase, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison and action plan so you can be ready to submit an offer and move quickly when the time is right.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”