If you're waiting for mortgage rates to come down, you want to be paying attention to what is happening with inflation and the economy. Unfortunately, figuring out where the economy is heading in 2024 is not an easy task.

We've been saying for a while that mortgage rates will start making meaningful progress lower once we enter a recession, but the economy has been surprisingly resilient even in the wake of the most aggressive interest rate hikes in history. As it stands at the start of 2024, the U.S. is still not currently in a recession, according to the traditional definition (a significant decline in economic activity that is spread across the economy and lasts more than a few months).

The job market remains one of the U.S. economy's main engines, with the nation's unemployment rate near a 50-year low and wages finally pulling ahead of inflation. At the same time, major companies in technology, finance, media and other key sectors have all recently announced sizable job cuts, with layoffs nationwide more than doubling in January from a month earlier.

This positive jobs report and continued delay of an economic downturn has given even more credence to those who believe the Federal Reserve will be able to achieve a "soft landing" for the economy - raising interest rates just enough to slow the economy and reduce inflation without causing a recession.

But is the U.S. labor market really as "healthy" as the headlines say? Let's find out.

January Jobs Reports Show Conflicting Numbers

In their analysis of the most recent labor data from The Bureau of Labor Statistics (BLS), MBS Highway notes that January's jobs report might not be the blockbuster that it appears to be on the surface.

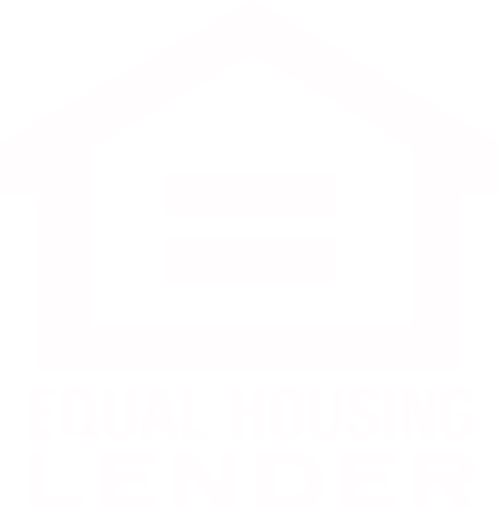

The BLS reported that there were 353,000 jobs created in January, which was nearly double expectations. Revisions to November and December also added 126,000 jobs in those months combined.

According to MBS Highway, while the headline job growth figure for January appears strong on the surface, future revisions lower are a very real possibility. January is always a heavily adjusted month, as new benchmarks, seasonal adjustments and population controls play a big role in calculating the data.

The Household Survey, where the Unemployment Rate comes from, is considered more real-time because it’s derived by calling households to see if they are employed. This survey has its own job creation component and it told a completely different story, showing 31,000 job losses.

Average weekly hours worked also declined to the lowest level since 2010 (excluding the pandemic). This is important because one of the ways businesses cut costs is to cut the number of hours worked. On average the entire labor force is working 30 minutes fewer per week, which equates to 2.4 million job losses on its own.

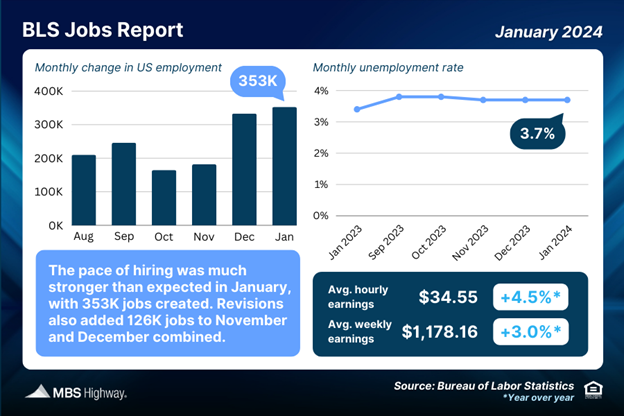

What's more, ADP’s Employment Report showed that private payrolls began 2024 slower than expected, with employers adding just 107,000 new jobs in January.

MBS Highway also notes that there was a surprising uptick in December's job openings.

The latest Job Openings and Labor Turnover Survey (JOLTS) showed that job openings were stronger than expected in December, rising from 8.925 million in November to 9.026 million. The hiring rate rose from 3.5% to 3.6% while the quit rate remained at 2.2%, suggesting there’s a lack of employers trying to entice workers with other offers.

There's also the unemployment claims. The latest weekly Initial Jobless Claims reached their highest level since November, as 224,000 people filed for unemployment benefits for the first time.

Continuing claims also surged higher, up 70,000 with 1.898 million people still receiving benefits after filing their initial claim. Both Initial and Continuing Jobless Claims have risen over the last two weeks to nearly three-month highs.

Why We Believe Mortgage Rates are Heading Lower

Inflation is declining, but further declines are dependent upon continued slowing in the labor market. The latest jobs numbers, while they might show some strength right now, hint at weakness that could encourage Fed policymakers to permanently halt any future rate hikes.

A slowing economy is deflationary, and mortgage rates always follow the direction of inflation: higher in inflationary markets and lower in deflationary markets.

Layoffs are a harbinger for slowing economy, and there has been an uptick in job cuts recently across technology and media. Alphabet, eBay, TikTok, and the Los Angeles Times have all recently announced layoffs. And just recently, Snap (the owner of Snapchat) announced it was cutting 10 percent of its workforce. UPS, Macy's, and Levi's also recently cut jobs.

We are seeing multiple indicators of layoffs, rising continued jobless claims, and a rising unemployment rate.

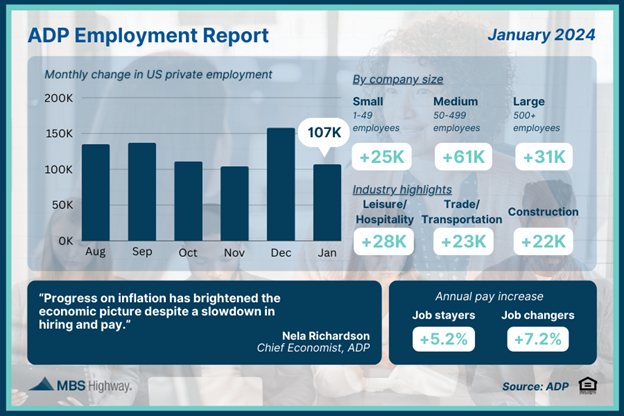

The unemployment rate has risen from a low of 3.4% in April 2023 to 3.7% currently. Every time the unemployment rate has bottomed and moved higher, a recession has followed. Recessions are deflationary by definition and therefore bring lower mortgage rates and greater housing affordability with them.

Looking back to 1970, we can see a pattern of lower mortgage rates during recessions. According to realtor.com, when mortgage rates push 7%, 20 million households are priced out of the market compared to when rates are at 3%. Essentially, this means that for every 1% drop in mortgage rates, 5 million more borrowers are able to afford a mortgage on a median priced home.

The Bottom Line

Mortgage rates will see some ups and downs for the next little while, but we anticipate them to continue a downward trajectory as more labor reports are released and the economy feels the effects of layoffs and unemployment claims.

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

But remember, a slowing market does not mean a crashing one! Even though mortgage rates have increased, demand for homes is still very high. This has led to home prices reaching all-time highs in many areas of the country.

Mortgage rates will drop when the economy slows down, which we expect to happen later this year or in the beginning of 2024. When that happens, even more people will want to buy a home. This will keep home prices rising, which means the sooner you buy a home, the sooner you will benefit and see your home equity grow.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”