The recent headlines broadcasting mortgage rates surpassing the 7% mark have instilled a sense of apprehension among potential homebuyers. In a market perceived as increasingly unaffordable, it's easy to feel discouraged. However, with the right mortgage strategy, you can transform this challenging market into an opportunity.

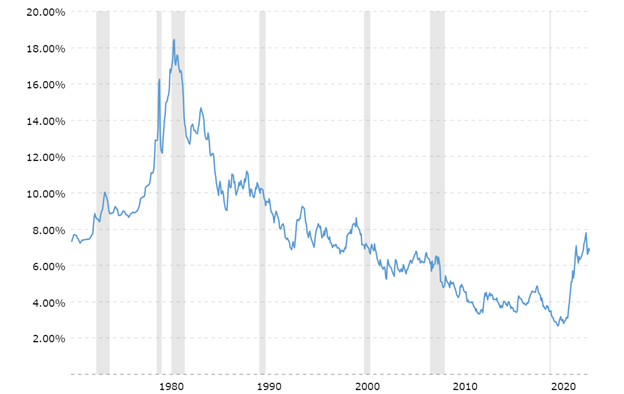

Historical Perspective on Mortgage Rates

While current rates hovering around 7% seem daunting, a historical review reveals a broader context. During the early 1980s, mortgage rates soared to 18% and even in more stable times, rates have frequently fluctuated above 10%. This historical perspective is vital because it demonstrates that while today’s rates are higher than in recent years, they remain within a historical long-term normal rate range.

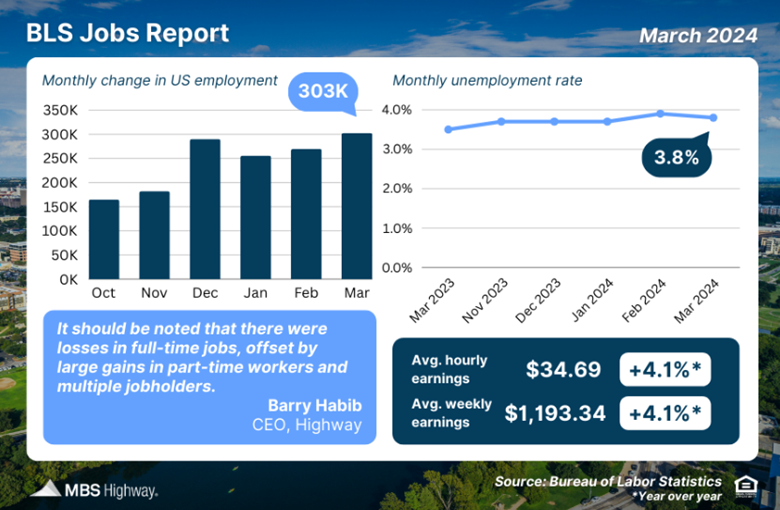

Impact of Job Growth on Housing Demand and Prices

Recent job market data presents a mixed but overall positive picture that could significantly influence the housing market. In March, the economy added a robust 303,000 new jobs, exceeding expectations, and revisions to prior months added another 22,000 jobs. The unemployment rate also dipped to 3.8%, signaling strong economic momentum. These indicators suggest a growing number of people entering or re-entering the workforce, which traditionally boosts housing demand as more individuals and families gain the financial confidence to purchase homes.

Increased Buyer Competition

The influx of new jobs and the overall decrease in unemployment are likely to lead more people to consider buying a home. As more individuals gain employment, the pool of potential homebuyers increases, leading to heightened competition in the housing market. This is particularly relevant in today’s environment, where housing inventory remains relatively low across many regions. Increased competition among buyers can naturally drive-up home prices, especially in desirable areas with extremely limited supply.

Appreciation Trends in Real Estate

The real estate market has consistently appreciated over the years, a trend that is likely to continue due to ongoing supply constraints and robust demand. Delaying a home purchase in anticipation of falling rates could result in higher prices later. Moreover, the longer you are in a home, the higher percentage of your payment goes towards principal reduction. This is called amortization, which is the math equation that determines how your mortgage balance will be paid off. In the first few years, most of your payments go towards interest costs, the longer you are in the home, the higher percentage of your payments go towards reducing your principal balance. Delaying buying both leaves you exposed to higher real estate prices and delays you from getting deeper into your mortgage loan where more of your payment goes towards principal.

Example Scenario: Imagine you are eyeing a $300,000 home today. With an average appreciation rate of 4% per year, the same home could cost about $312,000 next year. By waiting, not only do you pay $12,000 more, but you also lose a year’s worth amortization (paying down the loan balance).

Financial Drain of Renting

Continuing to rent while waiting for the perfect economic conditions means every rent check is an investment in someone else’s financial future. Renting offers no return on investment through appreciation or amortization.

Strategies to Win in Today’s Housing Market

Fully Underwritten Pre-Approval:

This step demonstrates to sellers that your financials are thoroughly vetted, significantly strengthening your offer in a competitive market. If you are going to complete against multiple offers, why not be the most prepared offer the seller will see?

Convert to Cash with our Power Buyer Program: By making a cash offer, you bypass many of the hurdles that come with loan financing, making your bid far more attractive to sellers.

Exploring Grant Programs:

Programs like those offered by Luminate can cover up to 2% of your down payment, reducing your upfront costs and facilitating easier entry into homeownership.

Adopting a Strategic Mindset:

The philosophy of "marry the home, date the rate" encourages purchasing the right home now and refinancing if and when rates drop. This strategy ensures you start building equity immediately and can take advantage of lower rates later.

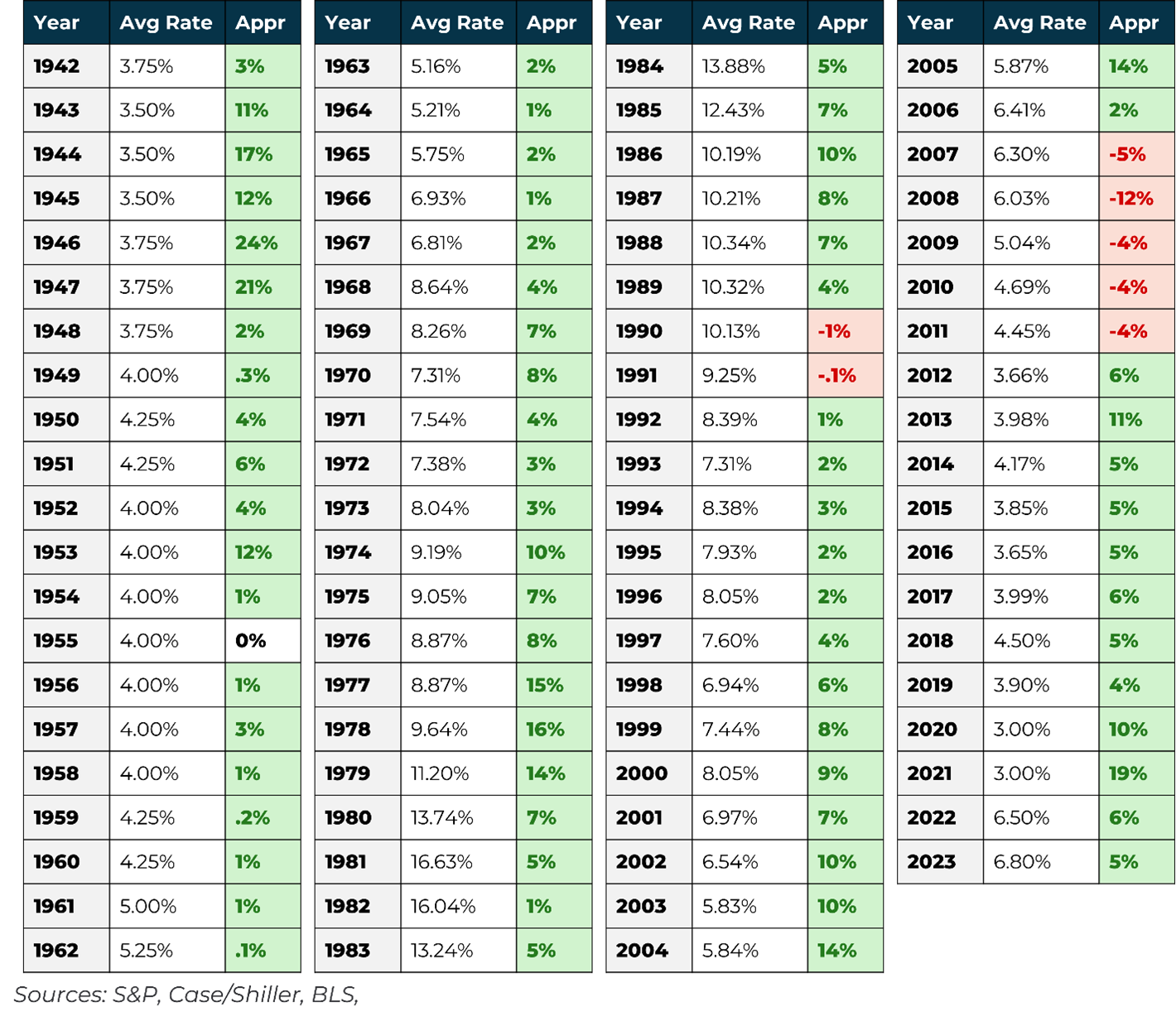

Despite the headlines highlighting soaring mortgage rates, it's important to understand that residential real estate prices have appreciated 74 out of the last 82 years. That means home values go up 90% of the time.

Carefully review the chart below that shows real estate prices going up in green, versus prices going down in red. Despite prior periods of elevated mortgage rates, home prices are much more likely to go up than down.

As rates are now on the rise, it may very well create an opportunity where a seller is willing to contribute towards a temporary interest rate buydown. What questions do you have and how can we help you?

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”