Now Could Be the Best Time to Buy a Home in Months as Affordability Improves

Seasonal home price cuts and a big improvement in mortgage rates over the last few weeks are contributing to a welcome improvement in homebuying conditions.

The surge in mortgage rates, limited inventory, and expensive home prices this year have resulted in a reservoir of pent-up demand from anxious and ready homebuyers. But with rates dropping over 0.5% in the last few weeks and more sellers lowering prices, that demand is slowly being released into the market. According to data from the Mortgage Bankers Association applications to purchase or refinance a home were up by 2.8% last week - the highest in five weeks.

The housing market is clearly showing signs of turning around. Let's dive into some of the big changes we've seen over the last few weeks and what they mean for your home purchase.

Inventory Increases Uncommon This Time of Year

Redfin recently reported that some “glimmers of hope” are emerging for prospective home buyers. The first one being that new listings increased 1.5% from a year ago during the four weeks ending November 5th. This was just the second increase since July 2022, which underlines the continued short supply in the housing market. Redfin noted that this increase is partly because new listings were falling during this period last year.

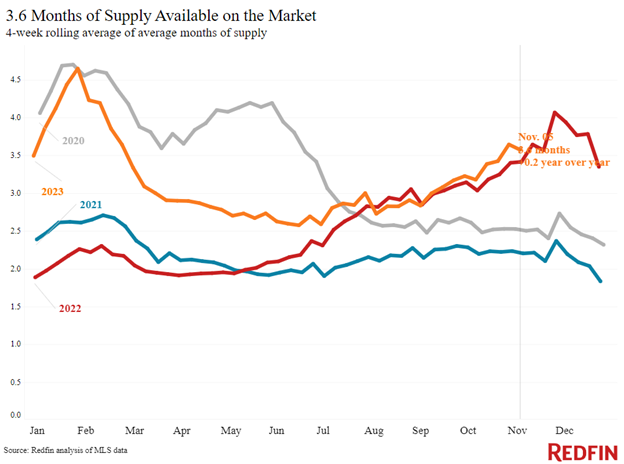

At the same time, active listings are at their highest level since the beginning of 2023, and months of supply ticked up 0.2 points to 3.6 months.

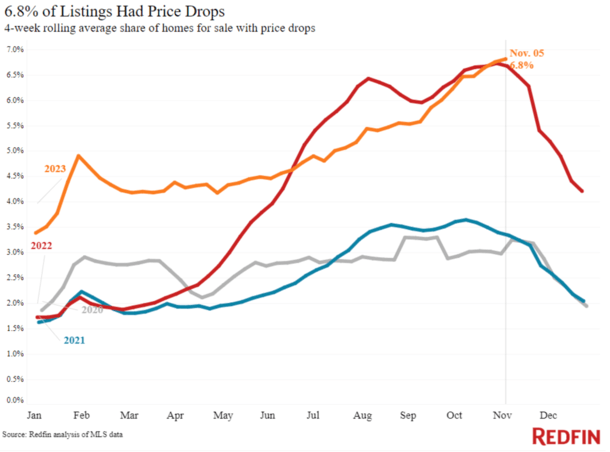

Inventory remains constrained nationally, with 4 to 5 months typically signifying healthy supply. But it is rising, which appears to be leading to price reductions. The share of listed homes with a price drop increased to 6.8%, a new record high.

More People Are Applying for Mortgages

Mortgage-purchase applications rose 3% from a week earlier during the week ending November 10, bringing them to their highest level in five weeks. That marks the second straight week of increases. And while pending home sales were down 8% year over year during the four weeks ending November 12%, that’s one of the smallest declines since April 2022.

House hunters are coming off the sidelines because mortgage rates are dropping from their peak: Average rates have declined from a two-decade high of 8% to the 7.4% range in the last month.

Mortgage Rates are Improving with Inflation

Inflation has been one of the biggest stories of the past two years. Prices have been high, and the inflation rate peaked in June 2022 at 9.1% year-over-year, leaving many families with less purchasing power despite having the same income.

However, the Bureau of Labor Statistics announced last week that the inflation rate for October 2023 was 3.2%. Mortgage rates calmed in response to the data showing that the economy is finally cooling off. This includes October's jobs report, which showed that job growth slowed quite a bit last month.

The 10-year Treasury yield, which mortgage rates closely track, also fell following the CPI data release and is now at its lowest level in almost two months.

Cooler economic data is good news for mortgage rates, because it means the economy is normalizing. Over the past couple of years, sky-high inflation has helped push up mortgage rates, and as inflation decelerates, mortgage rates should come down further.

Lower Rates Will Bring Sellers off the Sidelines

New listings of homes for sale are up 3% from a year earlier, the biggest increase in two years and just the second increase since July 2022 (the first was last week). The total number of homes for sale is near its highest level since the start of the year.

There’s a variety of reasons why more homeowners are putting their homes on the market: Some are noticing the small uptick in homebuyer demand, some are worried home prices are going to decline if they wait any longer, and others are ready to give up their low mortgage rate after realizing rates are unlikely to drop back to pandemic-era levels anytime soon.

The Bottom Line

We are still optimistic that 2024 will continue to bring lower mortgage rates and provide some relief for homebuyers.

This won’t be an immediate drop to 5% mortgage rates. We will likely see some ups and downs in the months ahead, but the recent economic reports are clear indicators that the trend has reversed from higher and higher mortgage rates to lower rates ahead.

If you are not ready to make a move just yet, here are 3 steps you can take now to prepare for when the time is right:

1. Schedule a meeting with a mortgage advisor (even if you are not ready to buy!)

It’s always best to do this sooner rather than later. No credit check or application needed – we will just discuss your options and put a plan in place so you can move quickly when the time is right.

2. Choose a loan program.

Every mortgage program has unique benefits and different requirements to qualify. If you learn about these now and choose the one that makes sense for you, you will have a solid roadmap for what you need to do to prepare for your purchase.

3. Start improving your finances.

Once we’ve decided on the best mortgage strategy, the rest of the time will be spent here. Get your down payment in order, make sure you have all your income and asset documentation, pay off any debt you need to improve your credit score, and start planning for your new housing payment.

Preparation is key in this market! Starting the process early will make sure you are able to submit an offer on a home right away and lock in a lower rate when the time is right.

If you would like to know exactly what you need to do to prepare for a home purchase, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison and action plan so you can be ready to submit an offer and move quickly when the time is right.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”