Debt-Consolidation Refinance: Use Your Home Equity to Pay Off Debt and Save Money

Even if you have a low rate on your mortgage, do you know how much you’re paying in interest each month for your credit cards, vehicles, and other personal debts?

Managing debts with high interest rates can feel like an uphill battle. Monthly debt payments take over a large chunk of your income, and it can feel like it will take forever to pay off the amount you owe. And with inflation and interest rates still elevated, more and more people are racking up balances and falling behind on their monthly debt payments.

Taking control of your finances and reducing debt can greatly reduce stress and provide a sense of financial freedom. If you find yourself overwhelmed with multiple debts, a debt consolidation refinance can help you consolidate your bills and simplify your financial obligations.

Let's explore what a debt consolidation refinance is and how you can use it to secure a strong financial future.

How Does a Debt-Consolidation Refinance Work?

To understand how this works, we need to discuss equity. Equity is the difference between what you owe on your mortgage and how much your home is worth. A debt-consolidation refinance allows you to tap into your earned equity to access cash and pay off debt.

Here’s a hypothetical situation: you bought a house for $200,000 with a $180,000 loan. Five years have passed, and now you owe $160,000 on the mortgage. The home has also appreciated and is now worth $300,000, which means you have $140,000 in equity.

Most debt-consolidation (or cash-out) refinance programs allow you to access up to 80% of your equity, so in this case you would be able to receive up to $112,000 to pay off any other debt balances you have (car loans, credit cards, medical bills, student loans, etc.). These debts are essentially wrapped into your mortgage, resulting in just one monthly payment.

Does a Debt-Consolidation Refinance Actually Save You Money?

Even though mortgage rates have been hovering in the 7% range lately, mortgages are still one of the least expensive ways to borrow money.

Paying off your credit card debt that has 20% interest or your car loan that has 11% interest can save you a significant amount of money and minimize your bills. Mortgage debt is also secured and has a fixed interest rate, so your payment will be the same over time compared to a credit card bill that is variant and compounds depending on how much you choose to pay each month.

It is important to note that this does not make your debt disappear. You are still paying it off, just at a much lower interest rate. This can save you money and improve your monthly cash flow by eliminating excess bills. Another perk is that mortgage interest is typically tax-deductible while other consumer debt is not.

Don't Forget About Closing Costs

You also need to understand how closing costs play into your decision. Closing costs are lender fees and third-party fees you pay when getting a mortgage. You must pay these on a refinance just like you did on your original mortgage.

Closing costs vary but will usually be several thousands of dollars. While these costs can often be rolled into your new mortgage rather than paid with a lump sum of cash (also called a no-closing cost refinance), they are going to add to your overall debt balance. This is money that could potentially go towards paying down your existing debts.

To determine if a debt-consolidation refinance is financially beneficial, you must weigh these closing costs against the overall interest savings you stand to gain from consolidating your debts.

A debt-consolidation refinance is not meant to be an escape from debt problems, but it can be a win-win situation when used as part of a responsible plan to manage your finances.

Debt-Consolidation Refinance Example

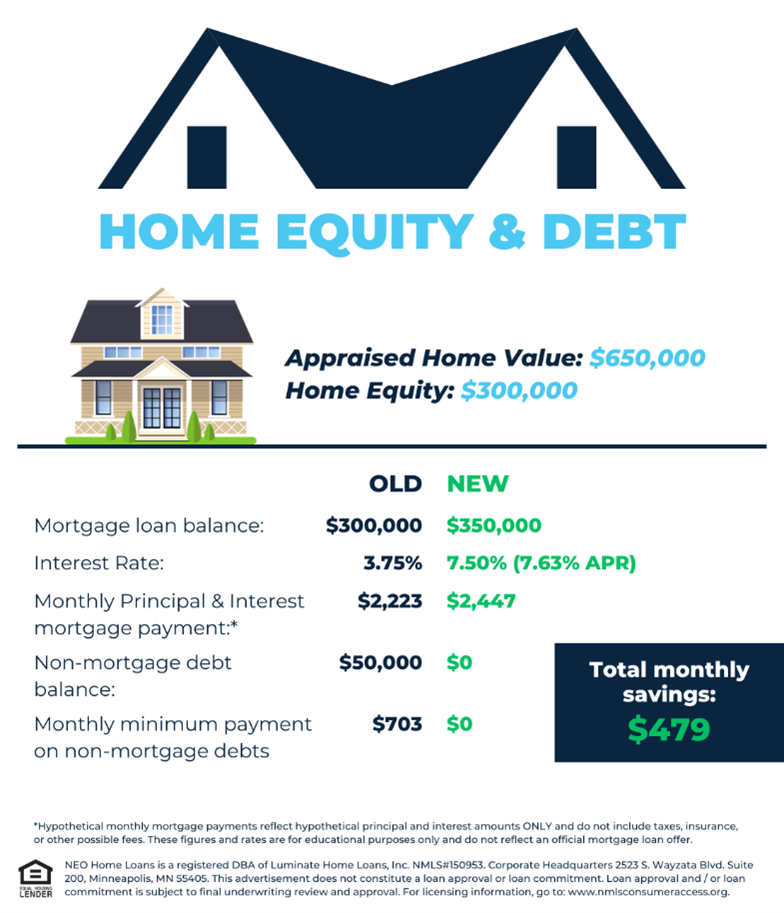

John owns a home worth $650,000, with a current mortgage on the property of $300,000 at a 3.75% interest rate. John experienced some financial strain related to a job loss in early 2020 when COVID became a global pandemic, and he has been struggling to pay off the $50,000 in credit card debt he accrued during that time.

With an interest rate of 17%, John’s credit card debt is costing him $703 per month in interest expense alone. He had considered consolidating the debt into his mortgage, but since his mortgage has an interest rate of 3.75% and the current interest rate on a debt-consolidation refinance is around 7.50%, he is hesitant to move forward.

Given John’s current mortgage interest rate, is he making the right decision? Let’s take a closer look.

Current Payment

John’s current principal and interest payment on his mortgage is $2,223 per month, and he is paying an additional $703 per month in credit card payments. These two debts combined total to a monthly payment of $2,926 per month.

New Payment

If John went ahead and consolidated his credit debt into a new mortgage with a loan balance of $350,000 and an interest rate of 7.50%, his new principal & interest payment would come out to $2,447 per month.

In contrasting these two scenarios, it’s clear that John would save $479 per month by moving forward with the debt-consolidation refinance. Not only would his monthly payment drop, but he would also be chipping away at the principal balance of the total debt each month, unlike his current scenario where he’s making interest-only payments on his credit card debt.

Benefits of a Debt-Consolidation Refinance

With this information top of mind, refinancing to consolidate debt offers a range of compelling benefits, including:

- Streamlined debt management. One of the primary advantages of debt consolidation through refinancing is achieving a much simpler financial life. Instead of dealing with multiple high-interest debts from various sources, you consolidate them into a single, more manageable payment. This consolidation streamlines your finances, reduces the complexity of tracking multiple due dates and payment amounts, and provides you with a clearer picture of your overall finances.

- Enhanced monthly cash flow. Consolidating high-interest debts through refinancing can lead to immediate financial relief. It can help provide more breathing room in your budget, making it easier to manage finances effectively and potentially improve your overall financial stability.

- Positive impact on credit score. Timely and consistent payments on your consolidated debt can positively impact your credit score over time. As you pay down your debt and maintain good credit habits, your creditworthiness may improve; this can open doors to better financial opportunities in the future, including access to lower interest rates on future debts.

- Potential tax benefits. In certain cases, the interest paid on mortgage debt may be tax-deductible, while interest on credit cards or personal loans typically is not. When you consolidate your debt through a mortgage refinance, you may gain access to potential tax deductions, reducing your overall tax liability. Consult with a tax professional for additional details.

- Long-term financial strategy. Debt consolidation through refinancing is not just a short-term fix; it can be a crucial component of your long-term financial strategy. By eliminating high-interest debt and creating a structured plan for repayment, you set yourself on a path toward financial stability and security. It enables you to regain control of your finances, reduce financial stress, and work towards achieving your broader financial goals.

Is a Debt-Consolidation Refinance Right for You?

If you have owned a home for a few years, you should not have to worry about drowning in consumer debt payments. Your home equity can be used to lower your monthly obligations, free up some cash flow, and give you financial peace of mind.

Before committing to a debt-consolidation refinance, however, you will want to view thorough Total-Cost analysis. This means understanding the total cost of the refinance (including closing costs) and comparing it to the potential savings to see if it will be worth it. It's crucial you consider how the new mortgage terms will impact your monthly budget and whether the long-term interest savings outweigh the upfront expenses.

If you believe that consolidating your bills through a mortgage refinance is the right step for you, our team is here to assist you. Our mortgage advisors will guide you through the refinancing process, helping you identify the best mortgage option and how a debt consolidation can help reduce your monthly obligations.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”