Housing Is on a Roll! Home Values Up, Mortgage Rates Down

The housing market has been a rollercoaster this year, and this past week took us on another wild ride in terms of home values and mortgage rates.

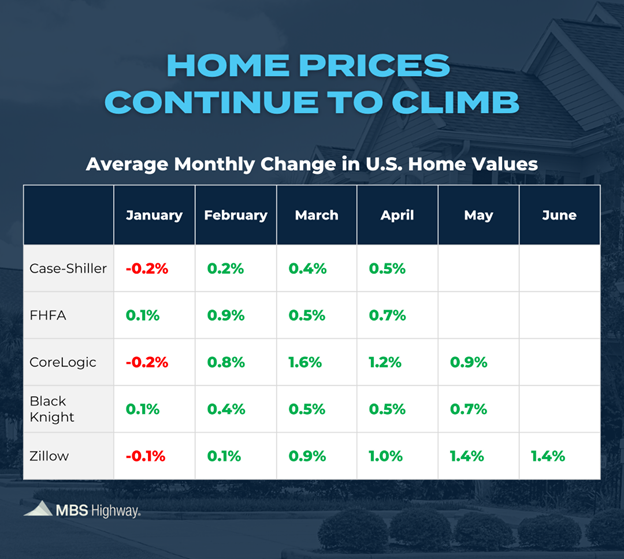

Recent reports from CoreLogic, Black Knight, and Zillow confirm that in many areas of the country, home price cooldowns were just mild corrections. Not only that, but many of the new numbers have eclipsed the ones we saw at the peak of the market in June of 2022.

Why the Housing Market is Surging

Low inventory is still the main factor behind the surge in home prices.

According to Black Knight’s May 2023 Mortgage Monitor, inventory improved modestly in May but was still 51% lower than the pre-pandemic supply of homes for sale. Many major markets have seen inventory levels decrease by an astounding 95% since the beginning of 2023.

Zillow’s June 2023 Market Report shows there were 28% fewer new listings last month than there were in June 2022, up from the 25% year-over-year decline in May.

According to Zillow:

It is worth pausing to contemplate just how low the trend ran in June, which is normally among the two or three busiest months of the year for new listings. This month only 376,500 new listings came to market, which is more comparable to the shoulders of the winter market doldrums, like February (about 341,500 average new listings) and October (about 384,100), than to the average new listings in June (505,100) in Zillow’s listings data which extends back to 2018.

The driving force behind the inventory shortage continues to be mortgage rates. Even though they have improved recently (more on that below), they remain much higher than pre-pandemic levels. The bond markets that determine mortgage rates are still reacting to recent Federal Reserve news that more hikes to the Fed Funds rate are likely coming in the near future, as well as economic data reports that show the economy is not slowing down as quickly as anticipated.

Mortgage Rates See Some Improvement

Housing inventory and mortgage rates are closely connected, as the record-low home inventory comes largely due to sellers feeling trapped by their low mortgage rates.

While mortgage rates are still much higher than all of us would like, they did improve fairly significantly recently following the release of the June Producer Price Index (PPI) – another closely watched economic indicator that measures price changes for goods and services (similar to the Consumer Price Index, but instead showing changes in wholesale prices rather than retail prices).

The latest PPI report showed that overall producer inflation increased by just 0.1% in June, which was lower than expected. And on a year-over-year basis, producer inflation fell from 0.9% to only 0.1%.

The markets saw this as a positive signal that inflation is moderating, which helped mortgage rates last week. According to MBS Highway’s market update from July 13:

Producer inflation is at extremely low levels and can lead to lower consumer inflation as producers can either pass on the savings or capture more margin. The Fed has to be pleased with both the CPI and PPI readings for June, but they will still be hiking late this month on July 26 by [.25%].

Basically, we are on the right track to lower mortgage rates that actually stick. As rates drop, it will encourage some sellers who have been reluctant to sacrifice their low interest rates to be less wary of putting their homes on the market, which could help the inventory problem. However, increased home affordability will also bring more first-time homebuyers into the market who will not be adding to the number of homes for sale.

What This Means for You

Our advice remains the same: if you are ready to buy a home, schedule a meeting with a mortgage advisor to find out how much you can afford with the current market conditions.

If you can make the numbers work, we still believe the best strategy is to pull the trigger on buying a home you love sooner rather than later. Your mortgage payment might be a bit higher than you would like initially, but you will be able to lock in your housing payment and immediately start building equity through appreciation. Rates will come down like they always do, and you will be able to refinance to a permanently lower housing expense.

If you’re ready to get started, we’d love to help you!