Will Waiting to Buy a Home Actually Save You Money? Let's Look at the Numbers.

Mortgage interest rates: it seems like all anyone can talk about these days. And with good reason. The basic equation of housing affordability boils down to just two main factors: home price and interest rate, which together make up that seemingly overwhelming number that is your monthly mortgage payment.

One of the things we hear almost daily from the homebuyers we work with is, "I hear that rates might be coming down, and I think I should wait." But while current interest rates might not be as enticing as they were two years ago and are expected to fall as the economy goes through a correction, that doesn't necessarily mean you should wait to buy a home.

Why you may want to buy now, despite higher rates

When deciding whether to buy a house now or wait, an important factor to consider is that interest rates often have an inverse relationship with housing prices.

As home prices increase, waiting for rates to drop might not yield the financial advantage you are hoping for. Not only will home prices be higher when rates come down, but there will be a lot more competition in the market. That means you could lose the ability to negotiate on price or ask for credits from the seller to cover your closing costs or buy down your interest rate.

The popular saying goes, "marry the house, date the rate." In other words, if you can get into the home you really want, you should consider it, even though mortgage rates are elevated right now. You can always refinance to take advantage of lower rates, but you won't always be able to find and buy the perfect home.

If you find the house that's right for you, more often than not it will be better to purchase now even with today's higher borrowing costs. You will immediately start gaining appreciation and paying down the principal balance on your mortgage. And if you plan on staying in your home for at least a few years, you will be able to refinance and recoup the costs associated.

How much could waiting to buy actually cost you?

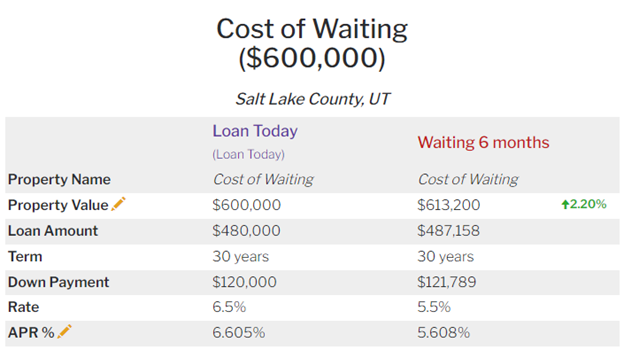

The images below are pulled from a sample Cost of Waiting Analysis* - a free comparison tool we offer at NEO Home Loans to help you make an informed decision on when to move forward with your homebuying plans.

Let's say you're in the market for a $600,000 home today, and the mortgage interest rate you qualify for is 6.5%. If you waited to buy - let's say six months - it's very likely you would get a lower rate because of where the market is heading.

We believe, as do many of the housing market and economic experts out there, that the average 30-year fixed interest rate will likely drop to around 5.5% in the first half of 2024. This is because mortgage rates historically follow the rate of inflation, and inflation has been steadily headed lower this year.

So, what exactly could you be saving if you waited in this scenario?

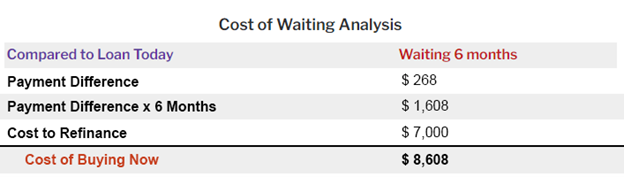

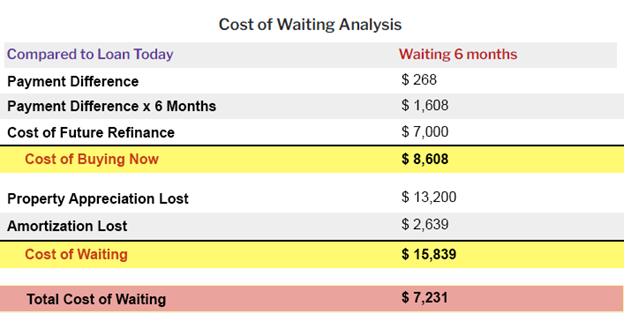

The payment on a 5.5% mortgage for a $600,000 home (with a 20% down payment) would be about $268 less every month compared to a 6.5% mortgage. That would add up to savings of $1,608 over that six-month period.

Waiting until rates drop would also mean you could avoid having to refinance. Refinance costs vary, but for this type of home purchase you could expect a refinance to cost you about $7,000. If you add that to the amount you could save on your mortgage payments, waiting until rates drop could save you a total of $8,608.

But remember! Home prices are projected to keep rising. Between July 2023 and January 2024, average home values in the United States are expected to increase about 2.2%. If you waited six months to get a lower rate, that $600,000 home would cost an additional $13,200.

Not only would you be losing out on $13,200 in appreciation, but you would also not benefit from amortization (repaying the principal balance of your loan). If you purchased the $600,000 home today, in six months you will have paid about $2,639 toward the principal balance of your mortgage. In other words, buying today would result in an additional $2,639 of home equity.

The math here is simple: saving $8,608 in monthly payment and refinance costs means you lose out on $15,839 in home equity (appreciation + amortization). That amounts to a total LOSS of $7,231.

In addition to the financial aspect, you should also consider how competitive the market will be once rates come down. When interest rates are elevated, there is less buyer demand. This means you have more homes to choose from and less competition for the best homes on the market. Buying when rates are elevated may be the only way to avoid a bidding war situation, which could put you at a disadvantage when it comes to getting your offer accepted and negotiating on price and seller concessions.

The bottom line is, both markets have their advantages and disadvantages. However, if you actually look at the numbers for your specific situation, it's likely you'll see that waiting to buy and trying to time the market will actually cost you more when all is said and done than buying now and refinancing later.

We understand that everyone's situation is different. Before making any decisions on your homebuying plans, it's crucial that you look at the numbers for your specific purchase scenario and financial situation. If you would like to see a Cost of Waiting Analysis for your area, similar to the one shown above, give us a call or fill out the form below to request a consultation with a mortgage advisor.

*Disclaimer: This information provided outlines the minimum down payment requirements as allowed by specific loan program and product guidelines. Loan program and terms of repayment are based on a 30-year fixed term. Interest Rate and Annual Percentage Rate as well as any and all credit offered would be subject to pricing and underwriting of the individual applicant. NEO Home Loans is a registered DBA of Luminate Home Loans, Inc. NMLS#150953. Corporate Headquarters 2523 S. Wayzata Blvd. Suite 200, Minneapolis, MN 55405. This advertisement does not constitute a loan approval or loan commitment. Loan approval and/or loan commitment is subject to final underwriting review and approval. For licensing information, go to: www.nmlsconsumeraccess.org.