Why Did Mortgage Rates Jump Recently?

If you’ve been following our blog, you know that we’ve had a positive outlook on mortgage rates dropping as we move into the second half of 2023. The reason for this has always been the anticipation of inflation data improving following the persistent interest rate hikes by the Federal Reserve, eventually leading to the economy slowing down and entering a recession.

However, some key reports that came out last week threw the mortgage market for yet another loop as rates went up to the highest they’ve been this year. Let’s jump into why that happened, and what we believe you can expect with mortgage rates going forward.

Federal Reserve Not Finished Hiking Rates

The minutes from the June 14th Federal Open Market Committee (FOMC) meeting were released last Wednesday, and they showed that the Federal Reserve plans on keeping the Fed Funds rate elevated for longer than many anticipated. Not only that, but they are planning on even more rate hikes this year (most members of the Federal Reserve believe there needs to be two more rate hikes this year to make any meaningful progress on inflation).

The announcement that inflation is not improving quickly contributed to the rise in mortgage rates last week. Mortgage rates are determined by the prices of mortgage bonds, and inflation is a bond’s worst enemy because it erodes the purchasing power of the bond’s future cash flows. If inflation is increasing, the return on a bond is reduced in real terms (meaning it’s adjusted for inflation).

Because of this, persistent high inflation reduces the demand that investors have for bonds like mortgage-backed securities. As demand for mortgage-backed securities falls, so do their prices. This results in higher interest rates for all mortgage types, and it’s why the minutes from the FOMC meeting discouraged bond investors and sent mortgage rates higher last week.

Strong Economy Shocking Investors

While the minutes from the FOMC meeting played a part in rates rising last week, the main culprit was the release of employment data that showed the labor market is still surprisingly strong.

According to HousingWire:

Economic resilience is taking investors aback. Consumer spending keeps growing, as do auto sales, which were expected to soften. Real estate markets also speak to resilient conditions, as buyers have accepted mortgage rates in the new normal of 6% – 7% range and kept a steady pace of sales over the past few months. In addition, builders are recognizing the demand and the opportunity it presents, and they are pushing construction activity higher – about one-third of homes on the market are new construction, more than double normal levels.

A strong labor market means a strong economy, and one of the consequences of a strong economy is inflation. The new employment data, just like the minutes from the FOMC meeting, signaled to bond investors that inflation is likely to persist and continue eating away at bond prices, which again pushed mortgage rates higher.

When Will Mortgage Rates Improve?

Mortgage rates will fall when the bond market becomes confident that there is meaningful progress on slowing down inflation. This could happen with an announcement from the Fed about when they will cease hiking rates, or through economic data that shows the economy is slowing down.

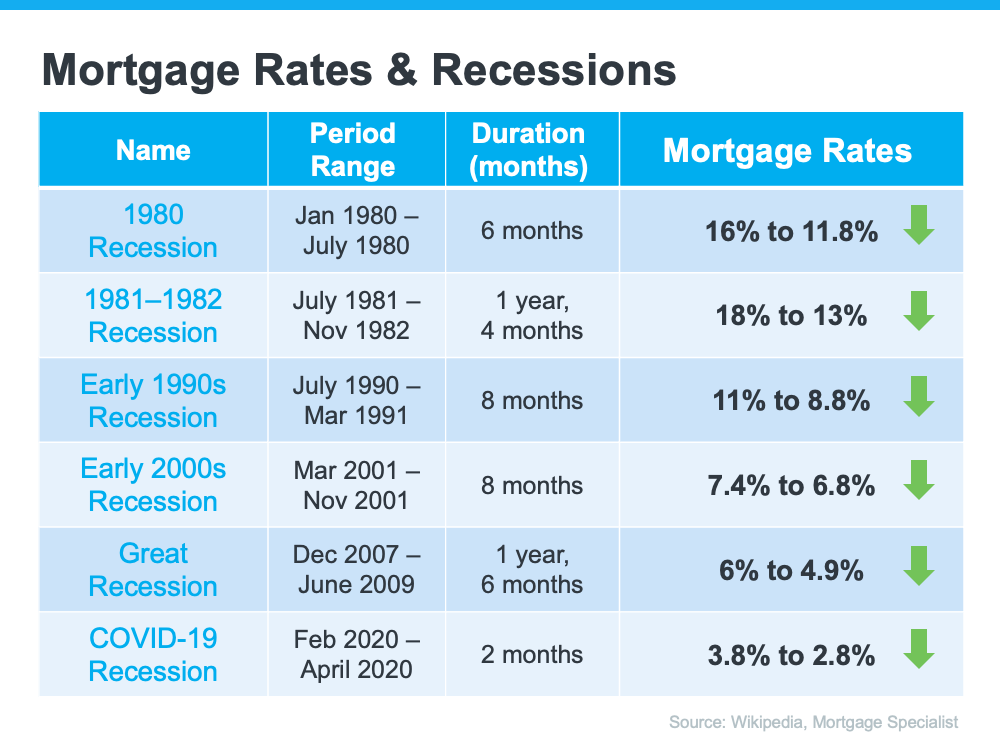

Recessionary periods have been a common occurrence over the past century and have produced attractive opportunities for long-term investors (like those looking to buy homes) because they bode well for mortgage rates. As you can see in the chart below, whenever the economy slows down, mortgage rates decrease in response:

The Bottom Line

Mortgage interest rates shot up last week because of the combination of anticipation of more rate hikes by the Fed and a strong jobs report. These hikes are going to increase the likelihood of a recession, which historically has led to lower mortgage rates. While we can’t predict exactly when this will happen, we still anticipate that inflation will improve and the economy will contract enough to encourage more activity in the bond market later this year.

If you’re waiting until rates drop to buy a home, make sure you are in regular contact with a mortgage advisor who understands economic trends and is constantly monitoring the movement of the markets. Our team at NEO is doing this every day, and we would be happy to advise, educate, and help you create a plan to invest in real estate at the right time and start building wealth.