Yes, Housing Will Become More Affordable, But Not for The Reasons You Think

If you Google “recession” today, you’ll find thousands of differing opinions from reputable financial and economic news sources about what to expect in the economy.

Some believe that a recession is inevitable and bound to happen soon thanks to record-high inflation and the Federal Reserve raising interest rates to fight it. Others are of the mind that low unemployment numbers and high wages mean the economy will keep chugging along despite the higher prices and borrowing costs.

Recessions are a big deal for the housing market because they mean lower mortgage rates (more about that below). In an environment where mortgage rates are rising, our job as mortgage advisors is to understand what economic factors are at play that will bring rates down so we can help the buyers we work with get the most favorable terms on their home financing.

We believe the current economic climate means a recession is certainly on the way if it is not already here. We also believe an economic downturn will alleviate some of the pain that homebuyers have been feeling in this historically expensive, competitive housing market.

Recession Signals Getting Louder

There are two main reasons why we believe a recession is imminent:

1. Consumers are running out of money

U.S. consumer spending increased by the most in six months in July as Americans bought more goods and services, even though prices are up everywhere.

The current pace of this increase in consumer spending is unsustainable. Households are drawing down excess savings accumulated during the COVID-19 pandemic. Student debt repayments resume in October for millions of Americans and higher borrowing costs could make it harder for consumers to keep using credit cards to fund purchases.

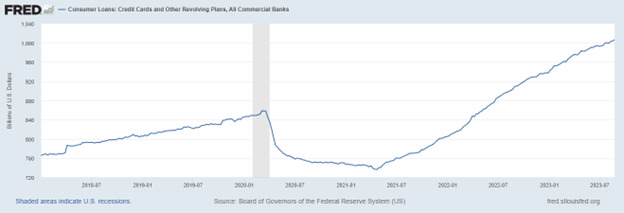

The below graphs show how the amount of revolving consumer debt (first graph) and the personal savings rate (second graph) in America have changed over the last five years.

Credit card debt and other consumer debt dropped significantly during the first year of COVID thanks to 1) government stimulus that was used to pay down debt; and 2) less discretionary spending because of lockdowns. But now that everything has returned to normal, consumer debt has skyrocketed to $1.5 billion higher than it was before the pandemic.

The personal savings rate has done the opposite. Americans were saving their stimulus and extra money in 2020 while they were stuck at home, but they have been tapping back into it significantly over the last two years.

The ability for people to use credit cards and spend their savings has an expiration date. Once those wells are tapped, Americans will stop spending, the economy will slow down, and we will be in a recession.

2. Inverted Yield Curve

Another way we can predict a recession is by looking at the difference between the 10-Year Treasury yield and the 3-Month Treasury yield, also known as the Yield Curve.

A healthy or normal yield curve is one where longer-term bonds have higher yields or interest rates than shorter-term bonds. For example, the 2-Year Treasury might have a yield of 3% while the 10-Year has a yield of 4%.

Longer terms mean more risk, so investors demand higher returns. However, when a recession is expected, the yield curve is not normal and becomes inverted. This means shorter-term bonds have HIGHER yields than longer-term bonds.

The graph below shows the historical difference between the yields of the long-term 10-Year Treasury bond and the short-term 3-Month Treasury bond. When the line drops below 0, it means that shorter-term bonds are offering higher returns than longer-term bonds.

New Paragraph

The gray bars in the graph represent U.S. recessions. As you can see, every time the yield curve has inverted, a recession has immediately followed – and right now the yield curve is the most inverted it has ever been. We take this to mean a recession is at our doorstep.

Longer-term yields are lower than shorter-term yields right now for two reasons: (1) the Federal Reserve has been pushing up short-term rates; and (2) investors who fear a recession are still putting most of their money in the safety of long-term government bonds rather than stocks. This is increasing the demand for bonds and pushing up their prices; and when bond prices go up, yields go down.

Plummeting savings levels, government stimulus drying up, and the inverted yield curve are the most glaring indicators of a coming recession, but there are many other factors at play. Jay Voorhees from JVM Lending shared some of these in a recent blog post:

- Major problems overseas that will spill over to the U.S.

- Quickly tightening bank lending/credit standards that also predict recessions with surprising accuracy.

- The impact of tight monetary policy and the lag effects from higher rates that have NOT been felt yet, as many companies, investors and consumers are only now being forced to refinance into higher rates.

- Rising credit card delinquencies.

- The impact of student loan payments resuming.

- A pending commercial real estate crisis – due to high interest rates and very high vacancy rates.

Why a Recession Will Be Good for Housing

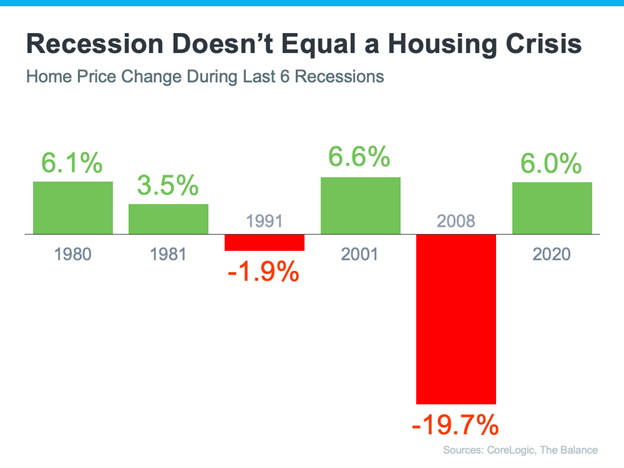

The impacts of recessions can be felt across the entire economy, everywhere from employment to spending to stock market movement, and even real estate. But while the stock market and the housing market can fall during a recession, it isn't guaranteed to happen.

In fact, falling home prices are less common than you may think. Home values have remained steady or risen during the last five recessions, aside from the Great Recession and the recession of 1990.

During the recession in 1980, which is a similar recession to the one we are going through right now (high inflation, high interest rates, etc.), home prices continued to rise at a good rate even though mortgage rates skyrocketed to nearly 18%.

The 1991 recession saw housing prices drop slightly for about a year, but then quickly bounce back.

In 2001, 9/11 created a big recession. Mortgage rates dropped, and the increased demand put upward pressure on home prices.

2008 was the only time we saw housing prices drop significantly, but that situation was very different. The decline in home prices actually caused this recession — not the other way around. Too much housing supply and not enough demand led to home prices tanking, and a recession followed.

Finally, in 2020, the Covid-19 pandemic brought on another recession. This one was so bad that the government started to print money. Housing prices started to creep up while everyone was sheltering in place, and they continued to rise nearly 16% over the whole year. In 2021, housing prices went up another 20%.

As for mortgage rates, they typically increase leading up to a recession, which is what we're seeing today. But once a recession hits, interest rates fall to stimulate spending and get the economy back on track.

Here’s what has happened with mortgage rates during each recession going back to 1980:

Historically, every time the economy severely slows down, mortgage rates decrease without fail.

The Bottom Line

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

But remember, a slowing market does not mean a crashing one! Even though mortgage rates have increased, demand for homes is still very high. This has led to home prices reaching all-time highs in many areas of the country.

Mortgage rates will drop when the economy slows down, which we expect to happen later this year or in the beginning of 2024. When that happens, even more people will want to buy a home. This will keep home prices rising, which means the sooner you buy a home, the sooner you will benefit and see your home equity grow.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”