Why We Believe Mortgage Rates Will Drop in 2024

We understand how incredibly frustrating and disheartening the current mortgage rate environment is.

Everybody had a prediction going into Summer 2023 that mortgage rates would decrease. Unfortunately, the resilient U.S. economy, the Fed’s ongoing war on inflation, and a sharp rise in 10-year Treasury yields have kept rates higher for longer than we all expected.

If you have the goal of buying a home soon, we know the most important question on your mind is: Should I buy a house now, or wait for mortgage rates to go back down?

Will Mortgage Rates Go Back to 3%?

Let’s put some things into perspective first - it is highly unlikely mortgage rates will fall back to 3% anytime soon, if ever.

When mortgage rates hit a record low of 2.65% in January 2021, it was because the Federal Reserve had artificially pushed them down by purchasing trillions in mortgage-backed securities (MBS) and lowering the fed funds rate to nearly zero.

These lower borrowing costs, combined with the massive amounts of stimulus that were pumped into the economy during the pandemic, are what led to massive inflation and mortgage rates nearly tripling from their record lows.

Long story short, we probably won’t see mortgage rates go back to 3%. But that doesn’t mean they need to stay at 7% either...

2024 Mortgage Rate Predictions

At the moment, we are optimistic that 2024 will bring lower mortgage rates and provide some relief for homebuyers. With the economy likely heading into a recession, it’s possible we’ve already seen the peak of this rate cycle.

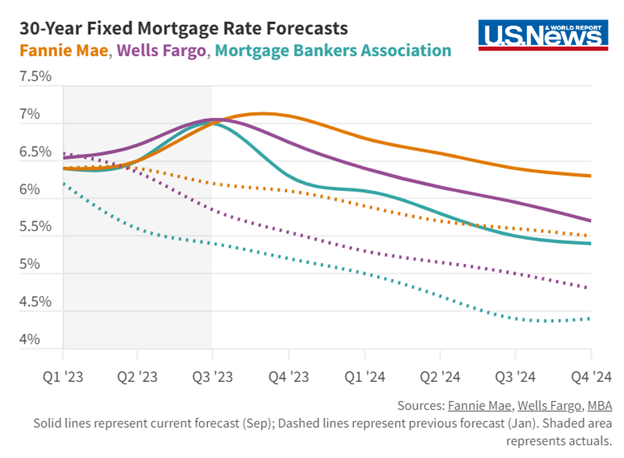

Of course, interest rates are notoriously volatile and could tick back up on any given week. However, nearly every economic forecast is predicting lower rates in 2024.

The Mortgage Bankers Association's Mortgage Finance Forecast for September 2023 predicts 30-year fixed mortgage rates will be in the 5% range for most of 2024:

- Q1: 6.1%

- Q2: 5.8%

- Q3: 5.5%

- Q4: 5.4%

What’s more, they predict that the 30-year fixed will stay low and average 5.1% in 2025.

Fannie Mae also releases a monthly Housing Forecast, and while their September predictions are not as optimistic, they still have 30-year fixed mortgage rates in the 6% range for the entirety of 2024:

- Q1: 6.8%

- Q2: 6.6%

- Q3: 6.4%

- Q4: 6.3%

Wells Fargo's latest U.S. Economic Outlook puts 30-year fixed rates pulling back to 6.75% in the fourth quarter 0f 2023, and its forecasting group predicts that rates will fall below 6% in the third quarter of 2024.

Finally, in their August Real Estate Market Outlook, the National Association of Realtors puts 30-year fixed rates at near 6% by early Spring 2024.

As it stands right now, the general consensus is for mortgage rates to be in the 5-6% range for 2024.

Should You Buy Now Or Wait?

The answer to this question first and foremost depends on your financial situation. If you are not financially prepared to take on a mortgage payment today, you should wait to jump into homeownership until you can comfortably afford it.

However, if you have met with a mortgage advisor, ran the numbers, and have the room in your budget, you should buy a home now.

Housing prices will keep going up like they always have. The home you want is going to be more expensive a year from now. Buying today means you will be able to lock in your home’s price before housing costs increase even more. If interest rates do go down as predicted, you can refinance to a permanently lower rate.

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it's likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more.

We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation. If you would like to see a Cost of Waiting Analysis for your area, similar to the one shown above, give us a call or fill out the form below to request a consultation with a mortgage advisor.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”