Why We Are NOT in a Housing Equity Crisis

“Housing slowdown leads to first annual drop in homeowner equity since 2012”

“Home equity is dropping. Here’s what to do now.”

These are just a few of the headlines that hit the news this week following the release of CoreLogic’s Homeowner Equity Report for the first quarter of 2023. The report shows that U.S. homeowners with mortgages have seen their home equity decrease by 0.7% compared to last year.

While it is true that homeowner equity is down compared to last year (which was expected, considering the home price declines we saw at the end of the year), the stories being shared neglect to paint the full picture and put these numbers in context.

Homeowners Still Have Record Amounts of Equity

Home prices rose rapidly during the ‘unicorn’ years of 2021 and 2022, and homeowners saw a massive boost in equity as a result. But even though that equity was impacted when prices fell slightly at the tail end of 2022, the data shows homeowners still have near record amounts of equity – amounts that are still much higher than before those unicorn years.

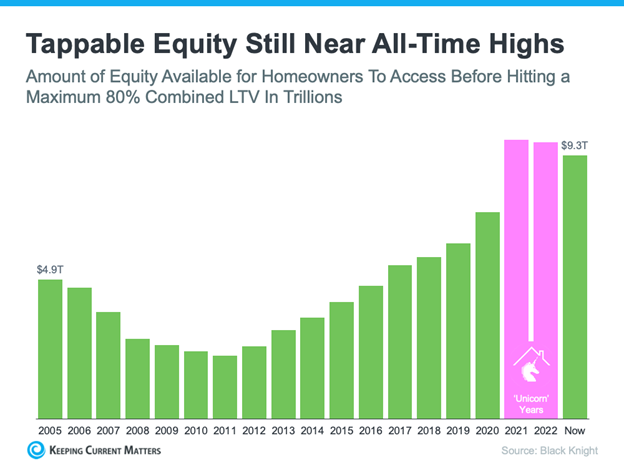

The graph below from Keeping Current Matters, created with data from Black Knight’s February 2023 Mortgage Monitor Report, helps illustrate this point by looking at the total amount of ‘tappable’ equity in the U.S. going all the way back to 2005. Tappable equity is the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio (LTV).

As you can see, the pink bars show there was a significant equity boost during 2021 and 2022 as home prices rapidly appreciated. But even though tappable equity has taken a slight dip as the market has corrected, it is still MUCH higher than at any time before the 2020 market boom.

Equity Losses Will Rebound Quickly

According to CoreLogic’s report, the equity losses reported amount to a mere $5,400 per homeowner. That is hardly a cause for panic, especially since Black Knight’s data shows the average mortgage holder had $178K in tappable equity at the end of February 2022.

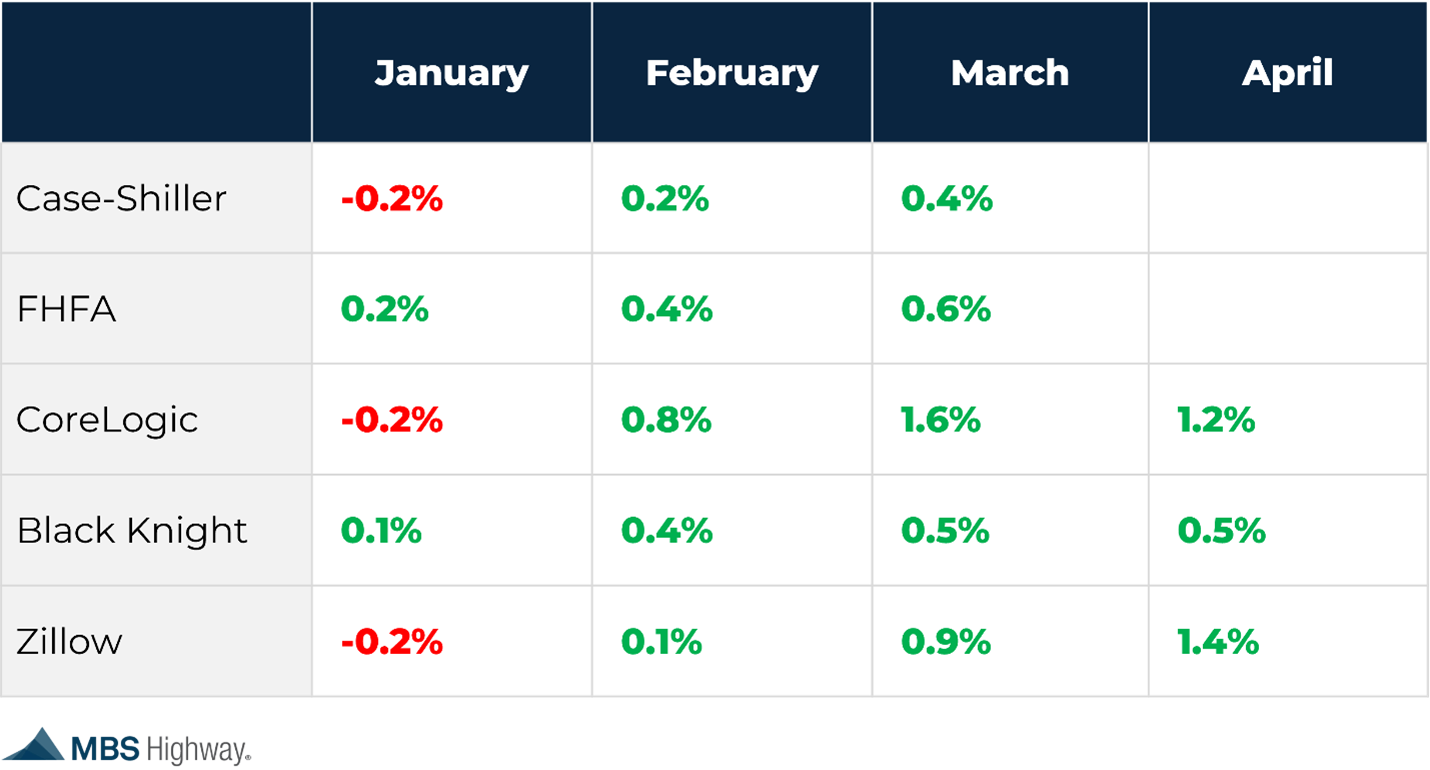

And those losses are already starting to be recovered. Recent home price reports show the worst home price declines are behind us, and prices have started to go up again. Here are the 2023 monthly appreciation numbers we’ve gotten so far:

These numbers make it clear that the housing market reached its trough at the beginning of 2023 and is on the rebound.

The Bottom Line

Empty heading

Average home equity has decreased slightly as the housing market has corrected. This was to be expected in the fallout from the housing market correction at the end of 2023, but it should not be a cause for panic. We have already started to see the market rebound as low inventory has kept home prices steady, and we are confident that this small equity decrease is the worst we will see.

While your home equity may have taken a very small dip recently, the only reason it would be a case for concern is if you are trying to sell a property you bought within the last 1-2 years. If you have owned your home for longer than that, you likely have plenty of equity that can be used to weather financial hardship, consolidate debt, or even move up to a better home.

If you would like to find out how much equity you have in your home currently, or would like to create an equity transition plan to use your equity to your advantage, fill out the form below to request a meeting with one of our mortgage advisors.