Home Prices Rise Again In April: What to Expect If You're Still Waiting to Buy

This week we received the April home price reports from CoreLogic, Black Knight, and Zillow; and just as we anticipated, they show that continued low supply and slightly higher demand led to another spike in home prices this spring.

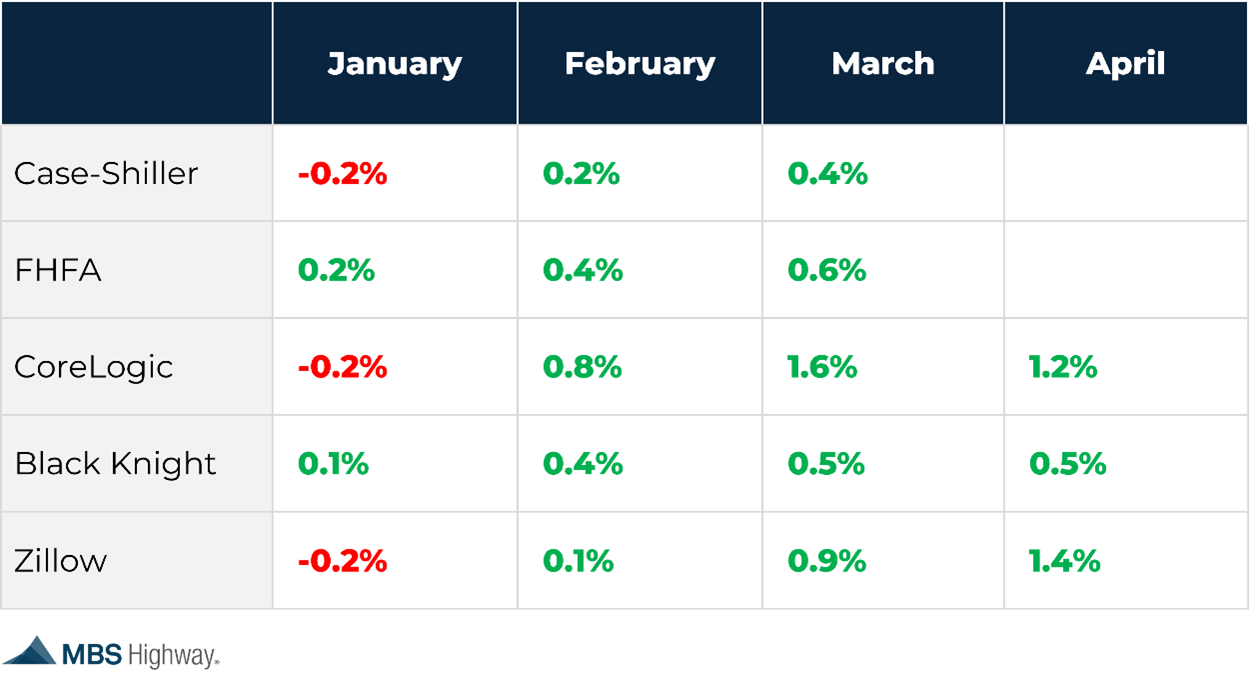

According to CoreLogic's U.S. Home Price Insights, prices increased by 1.2% in April 2023 on a month-over-month basis. Black Knight's Mortgage Monitor data shows a 0.5% increase, and Zillow reports an astounding 1.4% jump.

If we annualize the average of these numbers - meaning if these trends continue at the same rate through the end of the year - we would see almost 12% appreciation in 2023.

While that level of appreciation is highly unlikely, these are still big numbers - especially considering that a lot of people are not buying homes because they don’t want to give up their low interest rate, so demand is not nearly as high as it could be.

According to Black Knight:

Price strengthening this spring has erased more than 60% of the declines seen late last year at the national level, and at the current rate of growth would fully erase those corrections by mid-2023.

The chart below is from MBS Highway. These numbers make it clear that the housing market reached its trough at the beginning of 2023 and appreciation will continue at a sustained level as we move throughout the year.

CoreLogic forecasts we will see another increase of 0.9% when they release their data for May 2023, and Barry Habib and the team at MBS Highway anticipate we will see roughly 5% total appreciation in 2023. If these trends continue, it seems like those predictions will come true.

Inventory is Still Low

The reason home prices continue to rise is because there are still not enough homes on the market. According to Black Knight's report, inventory has declined in 95% of the major U.S. housing markets since the start of 2023.

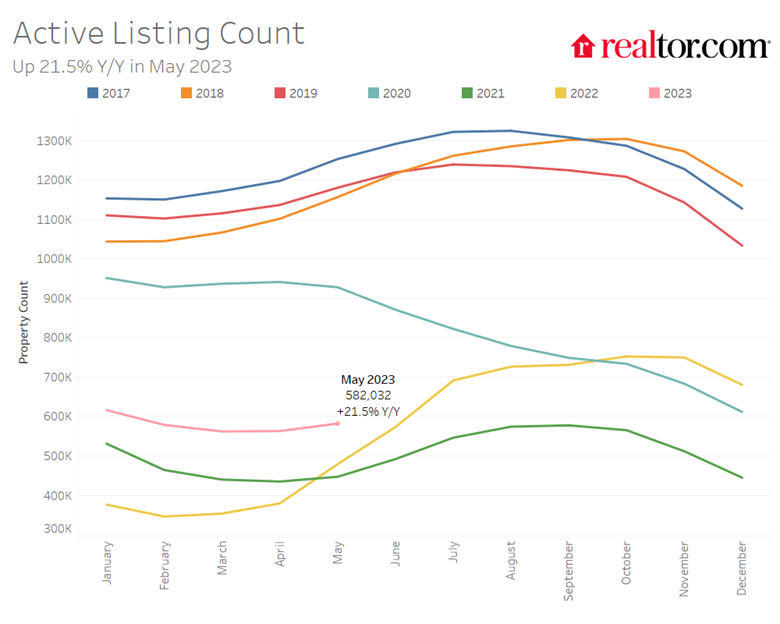

Realtor.com’s May housing data draws the same conclusion. While we are still seeing a small amount of month-over-month growth in active listings (a spike happens every year around this time), the growth rate is declining as sellers continue to list fewer homes than last year and buyers compete over the remaining affordable homes for sale.

While inventory has increased since last year, it is still drastically lower than the start of the pandemic.

When Will Affordability Improve?

The main driver of this shortage continues to be low affordability because of higher interest rates. Nobody wants to sacrifice their low mortgage rate, so they are staying put and hoping for rates to come down.

And we still anticipate they will. Rates did spike in recent weeks amid the U.S. debt ceiling standoff, but have started to trend back down since a deal was made. And if the Federal Reserve follows through with their recent comments that they may 'skip' another rate hike this month, we could see them come down even more.

Eventually, all of this economic turmoil will result in a recession. Many anticipate we may already be in one. Europe appears to officially be in a recession, and U.S. jobless claims recently hit a 20-month high suggesting that the labor market is softening as interest rate hikes stifle business growth.

Historically, mortgage rates increase in the months leading up to a recession, but they always fall when a recession sets in. We're well on our way, and we still anticipate rates to land somewhere around 5.5% by the end of this year.

Should You Still Wait to Buy?

Supply and demand economics are working to keep home prices steady, and there are still plenty of people out there who want to buy homes even in the face of higher rates. The problem is the majority of homeowners today have an interest rate on their mortgage below 4%. Many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost.

Rates will come down eventually, and there will be a surge of buyers looking for homes when they do. When that happens, it will be more difficult for you to find a home that meets all your needs and to negotiate on price and other concessions.

If you can afford it, we recommend starting the process now and taking advantage of the low competition. You will start benefitting from appreciation right away, and you will always have the opportunity to refinance and lower your payment when rates drop.

Creating an Equity Transition Plan

If you're worried about being able to afford a new mortgage payment in this market, we recommend working with a mortgage advisor to create what's called an equity transition plan.

The truth is the reason most people feel stuck in their home today is not because of their low interest rate – it's because they forget to consider their global household debt payment and they don’t create a plan to use their current home equity wisely and effectively.

It's a common misconception that when selling your home and buying a new one, ALL your existing equity should be used as the down payment so your new mortgage can be as low as possible. But what if instead of making a large down payment, you used some of your equity to eliminate all your other debt (car loans, credit cards, etc.) and reduce your GLOBAL household debt payment?

Creating an equity transition plan and finding a way to lower your global household debt payment is so crucial in this market. If you have significant home equity, putting less money down on your new home and instead paying off your other debt can make buying a home much more affordable – even with a higher interest rate.

Check out our recent blog post to see one of these plans in action. If you'd like to see specific options for how you can use your equity to lower your next mortgage payment, fill out the form below to request your own equity transition plan.