The Straightforward Real Estate Strategy for Financial Independence

Have you taken the steps to be in control of your financial freedom?

When it comes to the net worth and future financial security of Americans, the outlook is not very positive. According to a recent study by Credit Karma, 31% of Americans have a $0 or negative net worth.

Even more concerning is that a significant population of aging Americans (those who may soon be looking to retire) are in the same boat. 21% of respondents aged 59 and above reported having a net worth of $0 or less.

And when it comes to retirement savings, 27% of respondents said they don’t have any money saved for retirement right now, including 401(k) and Roth IRAs.

If you fall into any of these groups - how do you plan to fund your retirement? In a low inflationary environment, social security might be enough to live off of in retirement. ssa.gov says Social Security should replace 40% of your pre-retirement earnings.

But in an environment with rapid inflation, 40% of your pre-retirement earnings might not be enough to live off in your retirement years. As prices of everything go up, you are going to want another nest egg for financial security.

How to Fast Track Your Financial Freedom With Real Estate

Building a real estate investing strategy can give you solid streams of passive income in retirement and help you avoid the roller-coaster of 401(k) plans and other traditional retirement vehicles, which may or may not provide the cashflow you need later in life.

You begin the process by turning a primary residence into an investment property and then buying a new home for you and your family to move into. Every two to five years, you add to your portfolio by buying another home and turning your departing residence into another rental property. The benefit of this strategy is reduced down payment requirements, better interest rates, and the time to learn how to be a landlord one property at a time. With proper planning, you’ll have enough properties to generate significant income for retirement.

If you’re just starting out in real estate investing, the positive cash flow will not begin in year one. However, over time, your rents will increase, and you’ll gain equity in the home as the value goes up and your mortgage balance goes down.

Let’s take a look at an example of how much your wealth and passive income could grow in 10 years if you bought your first investment property today and grew your portfolio to four properties - with NO money out of your pocket.

Case Study: Real Estate Investing Over 10 Years

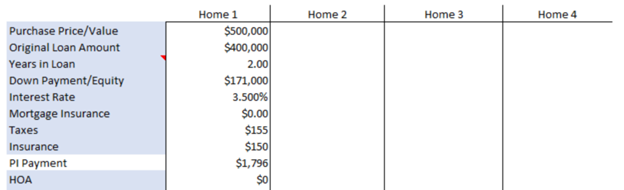

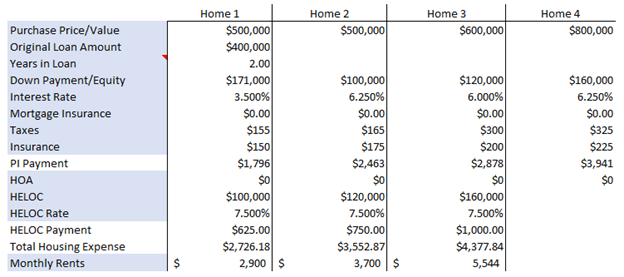

This client purchased a $500,000 home in March of 2021 with a 20% down payment at a 3.5% interest rate. With principal, interest, taxes and insurance (PITI), their monthly mortgage payment is $2,101.

The home value has appreciated 14% since they bought it in 2021, which means they have $171,000 in equity.

To begin their real estate investment portfolio, they decided to purchase a new primary residence and rent out their current home. After careful market research, they learned they could rent out their current home for $2,900 per month.

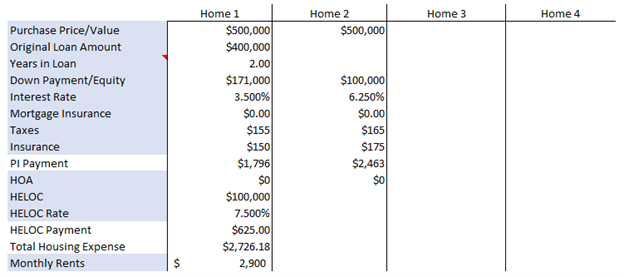

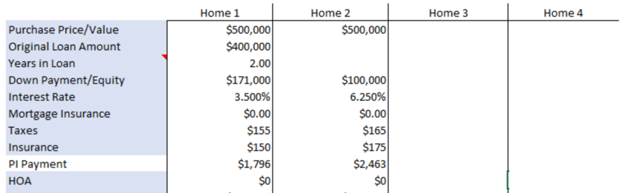

They decided to buy another $500,000 home, and to cover the down payment they took out a Home Equity Line of Credit (HELOC) on their current property. Their current home is worth $571,000, and with their outstanding mortgage balance they were able to borrow the $100,000 needed for the down payment at 7.5% interest rate.

They purchased the new property in April 2023 at an interest rate of 6.25%, putting their new monthly mortgage payment at $2,803.

They moved into their new home and will start renting out their first property for $2,900 per month. With a monthly HELOC payment of $625, their total housing expense on their first property is now $2,726. If there are no other expenses on the property, they will have a positive monthly cashflow of $174 - not much, but a great start!

Keep in mind, they will most likely be able to increase the amount of rent collected on the property every year. According to Credit Karma, the average year-over-year increase in rent was 5.77% nationwide from 2017-2022.

They now own two properties with several new benefits:

- They are building wealth through appreciation on both properties

- Their tenant will be paying their first mortgage for them

- They are generating passive income that will increase every year

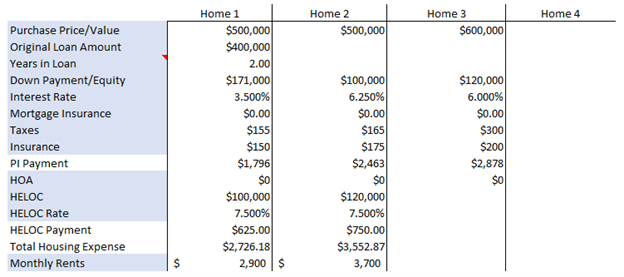

Now let's fast forward 5 years. They've enjoyed living in the second home they purchased, but now they would like to upgrade their living space while building their real estate portfolio even further.

So what do they do? Repeat the process! Take out a HELOC, this time on their second property, and use that money for a 20% down payment on their third property. Their housing expense will increase again with the HELOC payment, but the new rental income should offset that cost and put even more positive cashflow in their pocket.

Now they have three properties appreciating every year and growing their net worth, two of which are providing a growing amount of steady cash flow.

Finally, let's jump ahead three more years - eight years into their financial freedom journey. They've outgrown their third property and are ready to move one last time - this time to the perfect forever home.

They repeat the process a final time, taking out another line of equity on their third property and renting it out.

Now they only have two years left until their 10-year goal of being financially free - but is it possible?

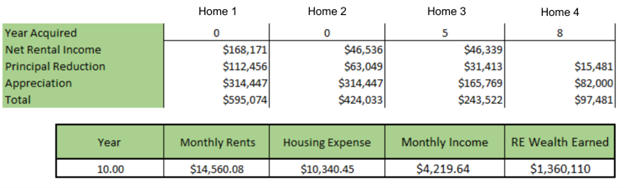

Here's what their monthly income and real estate net worth would look like after 10 years if they kept following this strategy. This is assuming an annual rent increase of 4% and annual appreciation of 5% for each property:

After 10 years, they would see a monthly cashflow of $4,219. And after taking into account the principal reduction paid on their mortgage and the amount of appreciation, they would have $1,360,110 in real estate wealth!

The Bottom Line

As you can see, building a real estate portfolio is possible even today, and it is one of the best strategies to achieve financial independence and retire early - and you don't need hundreds of thousands of dollars to do it! By leveraging the power of rental income and property appreciation over time, you can build a solid portfolio of properties that generate steady cash flow and grow in value.

However, just like any other investment, real estate carries risks and requires careful planning, research, and management. It's important that you educate yourself, understand the market you are investing in, and work with an experienced mortgage and real estate team that will advise you during your journey.

With the right strategy and approach - and a long-term mindset to maximize your returns and minimize your risks - you can achieve your financial goals and enjoy the freedom and peace of mind that come with financial independence.