New Home Price Reports Show Why the Housing Market Correction is Over

In case we haven’t said it enough, it’s time to stop waiting for home prices to drop!

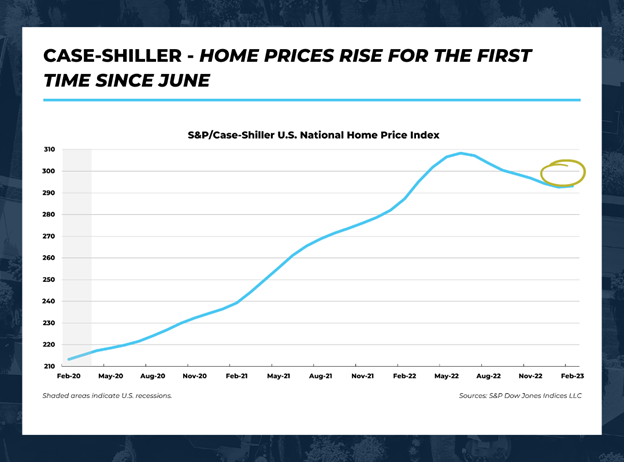

This week, we got even more indication that the housing market correction is behind us. The Case-Shiller National Home Price Index, which is one of the leading measures of U.S. residential real estate prices, rose 0.2% in February 2023 compared to January. This is the first time the index has shown an increase in the average home price since June 2022.

As of February (the latest index that is available), seasonally adjusted home prices are only down 2.8% from their peak in June 2022. And on a year-over-year basis (compared to February 2022), prices are up 2% nationwide.

Need more proof? The Federal Housing Finance Agency (FHFA) also recently released it’s house price index for February, and it shows that house prices increased by 0.5% in February compared to January. Year-over-year the index is up 4.0% (both numbers non-seasonally adjusted). Compared to the June 2022 peak, FHFA’s numbers are only down .2%.

What does this mean? The moderation in home prices we’ve been experiencing thanks to high interest rates is losing steam. Earlier this year we started to see see new-home sales rise and mortgage applications bottom out, and this rise in prices is the next step toward a healthy housing market with continued appreciation.

Why Are Prices Rising?

The reason home prices fell last year is not complicated – higher interest rates made monthly mortgage payments a lot more expensive. This, combined with the Pandemic Housing Boom that resulted in a 41% increase in home prices from summer 2020 to summer 2022, reduced housing affordability to the lowest it had been since the housing bubble that preceded the Great Recession.

So why are prices rising again? Improvements in housing affordability and a continued undersupply of homes.

Home prices are determined by two things: supply and demand. Yes, there are few buyers in an inflation-heavy economy with high interest rates, but in order for home prices to go down there needs to be fewer buyers than sellers – and that is just not within the realm of possibility today.

There is a lot of pent-up demand in the housing market right now that has been kept at bay because of the affordability problem. But as affordability improves, we are going to continue to see more people move forward with their homebuying plans.

And affordability has been consistently improving this year as rates have fallen and prices have moderated. As we move into the busy summer buying season, you can expect prices to continue to climb as the warmer weather and lower interest rates bring even more buyers into the market.