Pending Home Sales: Another Sign of a Strong Housing Market

Once again, new reports about the housing market show that the residential real estate is remaining strong despite high costs and economic volatility.

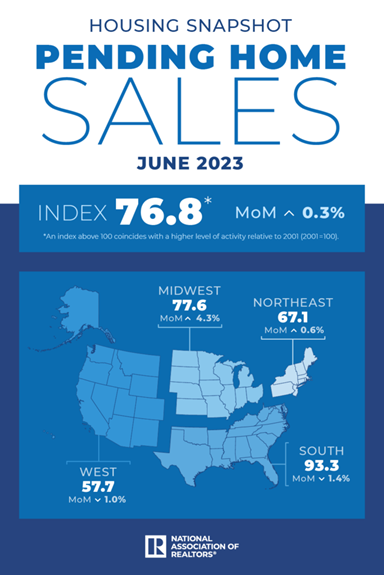

Last week, the National Association of Realtors (NAR) released a summary of pending home sales data. The report shows that pending home sales rose 0.3% from May to June, which was stronger than previous estimates of a 0.5% drop.

These numbers mark the first increase in pending home sales since February and show a lot of strength in the housing market. This is even more promising when you consider that mortgage rates were near their highs of 7% and home inventory was down 14% year over year during that period.

Pending home sales is a forward-looking and leading indicator of housing market activity. It is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract before it is sold, these numbers tend to lead the existing-home sales data by 1 to 2 months.

June's pending home sales data shows that although mortgage rates remained high in June, home buyers are starting to accept the higher borrowing costs and still moving forward with their homebuying plans.

According to NAR Chief Economist, Lawrence Yun:

The recovery has not taken place, but the housing recession is over. The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply. Homebuilders are ramping up production and hiring workers.

The existing home market continues to be hampered by two forces: years of underbuilding (made even worse by supply chain challenges over the last few years), and lackluster selling interest among homeowners who are just fine holding onto their existing low-rate mortgages.

We've been seeing the price effects of the low housing supply for months now. Home prices have been steadily rising since February, and in many areas have already eclipsed the prices we saw at the peak of the market in June 2022.

According to Yun, home supply needs to be expanded as much as possible to widen access to homebuying for more Americans. Home prices will be influenced by how much inventory is brought to the market. Increased homebuilding will tame price growth, while limited construction will lead to home price appreciation outpacing income growth.

And more inventory could be coming soon. According to a new report from Zillow, nearly a quarter (23%) of homeowners said they are either considering selling their homes within the next three years or have their home listed for sale currently. That's an increase from 19% at the beginning of this year, and 15% this time last year.

Should You Still Wait to Buy?

Supply and demand economics are working to keep home prices steady, and the pending home sales numbers show there are still plenty of people out there who want to buy homes even in the face of higher rates.

Rates will come down eventually, and there will be a surge of buyers looking for homes when they do. When that happens, it will be even more difficult to find a home that meets all your needs and to negotiate on price and other concessions.

If you are in the market to buy a home and you can afford a mortgage payment, we recommend starting the process now and taking advantage of the low competition. You will start benefiting from appreciation right away, and you will always have the opportunity to refinance and lower your payment when rates drop.

If you would like to know more about your options for purchasing a home, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all of your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.