5 Ways Trying to "Time" the Housing Market Could Cost You

It's a hard pill to swallow - buying a home today is a lot more expensive than it was a few years ago.

If you're a renter who's ready to own a home, or a homeowner who’s decided your current house no longer fits your needs, the desire to wait for home prices and interest rates to drop significantly is strong. It MUST happen, right? It happened in 2007 and 2020, so it has to happen again!

In a perfect world, mortgage rates and home prices would both fall at the same time. This has happened in the past, but the occurrences are VERY rare.

Home prices dropped severely from 2007-2009 during the subprime mortgage crisis and the runup to the Great Recession, but that's the only time in the history of housing market data that prices fell substantially. The next largest drop happened just recently in the last half of 2022 as interest rates skyrocketed. However, that drop was minimal compared to the housing crash, and it happened after two years of the fastest pace of home appreciation in history.

Other than these two periods of time, home prices have consistently gone up. Sure, there are always small variations in home values due to both macroeconomic factors (the economy and interest rates) and microeconomic factors (what's happening in a specific neighborhood or city), but these are very minimal and have little to no impact on your wallet when buying a home.

Interest rates, on the other hand, are solely influenced by investor demand in the bond market, which moves in response to macroeconomic factors like inflation, economic growth, and monetary policy.

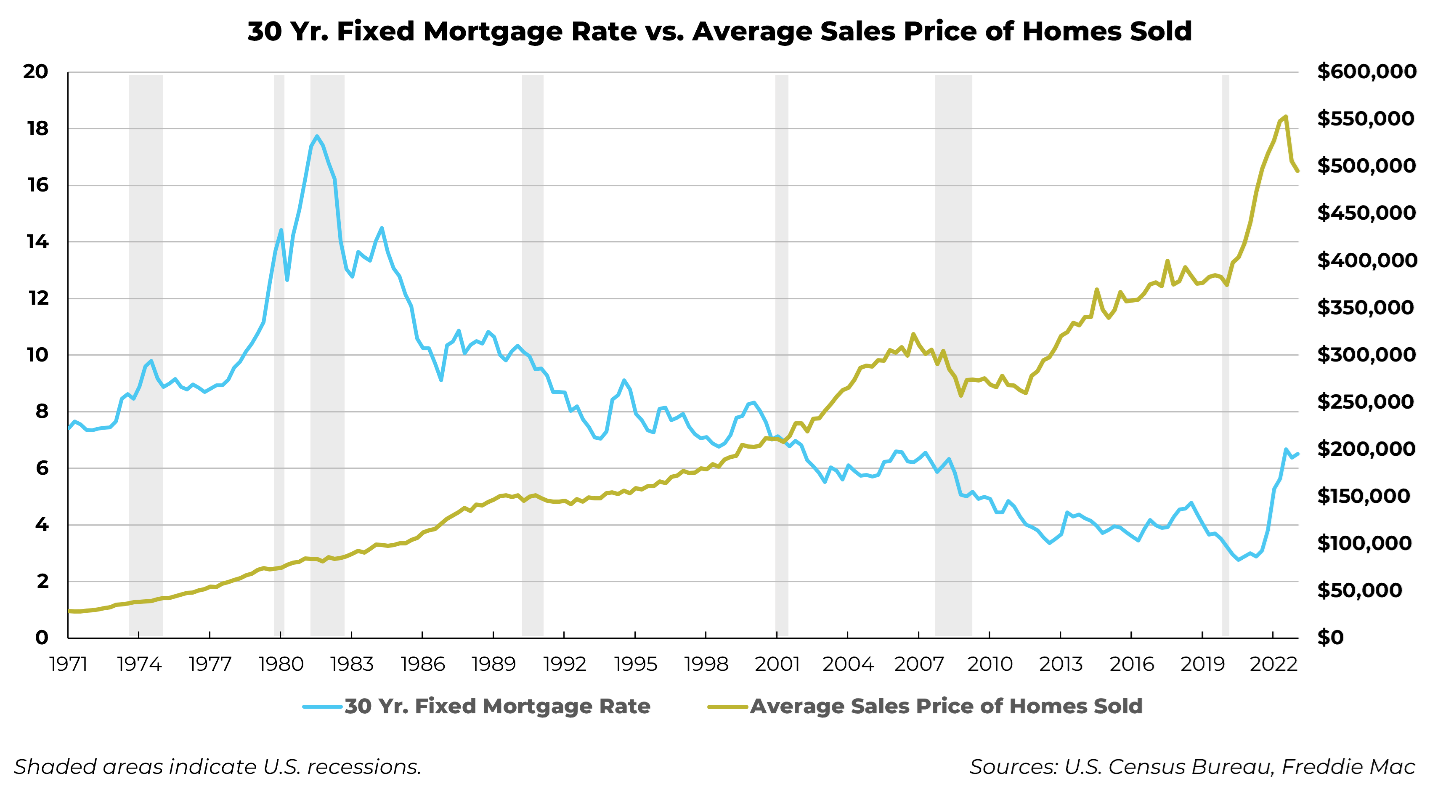

Check out the chart below with data from the Federal Reserve Bank of St. Louis showing average 30-year fixed mortgage rates (blue line) and average sales price of homes sold (yellow line) since 1971.

Home prices consistently go up, and interest rates are much more volatile. Other than the lead up to the Great Recession, there have only been very short-lived periods when interest rates and home prices have fallen in tandem.

All this is to say that market timing is great in theory, but while you’re waiting for both prices and rates to drop, the market is moving without you.

The 5 Biggest Costs of Trying to Time the Housing Market

It’s easy to think putting off a big financial decision like a home purchase is a smart move—and it can be. Not everyone should buy a home now. If you need to work on your credit, save for a down payment, or establish an emergency fund, then you should wait to start the homebuying process.

However, if all your ducks are in a row and you’re just drumming your fingers waiting to get the "best deal" on a home and mortgage, then it's important to understand the true costs of waiting.

1. The home you want will be more expensive.

Prices might seem relatively high now, but it’s important to remember that homes historically retain and increase their value over time. While prices do fluctuate in certain markets, because of the supply and demand imbalance, there will not be any significant and sustained home price declines.

2. Your rent will be higher.

According to ipropertymangement.com, average rent prices have increased 8.85% per year since 1980. While the cost of buying a home remains high, more people are going to remain in the rental market which will keep rent prices elevated. Rent prices are also affected by inflation, whereas as a mortgage payment is not.

3. You will miss out on home equity.

Homeownership helps you build wealth by providing you with equity in your home—the portion of your home that you actually own outright. As you make mortgage payments and your loan balance decreases, your equity will increase. If you wait until the right time to buy and continue renting, you are paying money every month that you will never see again.

4. You could lose the ability to negotiate.

Arguably the biggest benefit of buying a home in a "buyer's market" (when demand for homes is lower than supply) is your ability to negotiate on the terms of your home purchase. These negotiations can impact the price of the home and the amount of seller credits or concessions you receive. Pulling either of these levers can save you a substantial amount of money on your purchase.

When competition for homes is low, you have more opportunity to negotiate with sellers on price reductions and credits for closing costs or interest rate buydowns. Once that “perfect” time to buy a home comes around, there are going to be a lot more offers on the home you want. That means the seller dictates the terms, not you.

5. Interest rates could increase even more.

The short-lived era of 3% interest rates for 30-year fixed mortgages is over, and unlikely to return anytime soon — perhaps for decades. That’s because average 30-year fixed mortgage rates of 3% or less were an anomaly related to the pandemic, lasting from about July 2020 to November 2022. Historically, mortgage rates have been closer to an average of 7% over the past 50 years, according to Freddie Mac data.

Is it impossible to predict exactly what will happen with interest rates. While we can get a good idea based upon inflation numbers and what the Federal Reserve is going to do with their monetary policy, there are many other factors at play that affect mortgage rates like inflation and the state of the economy.

The Bottom Line

Whether you're a first home buyer or a seasoned investor, timing the housing market is extremely difficult. There will always be pros and cons when buying a home in ANY market.

If you are in the market for a home and you are able to afford it, now is the time to start the homebuying process. Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.