Looking Back at the Savings and Loan Crisis to Predict Future Changes in Home Values

In light of the multiple large regional banks recent failures and sustained pressure on the banking industry, many are worried about buying a home in fear that the turmoil could cause home prices to fall.

This is understandable – most people have their vision clouded by the memory of Great Recession that was caused by the housing market meltdown. But in reality, today’s economic uncertainty is much more reminiscent of a financial disaster that began two decades before.

The effects that have spread through the banking system after the recent turmoil are very similar to the Savings and Loan (S&L) Crisis of the 1980s and early 1990s. Both then and now, the Federal Reserve was rapidly hiking interest rates to fight inflation, but doing so at the cost of devaluing interest rate-sensitive assets, like the U.S Treasuries and mortgage-backed securities that make up a large portion of many banks’ balance sheets.

The Savings and Loan Crisis: A Brief Overview

The S&L Crisis was a major financial event in the United States that unfolded between 1986 and 1995. This slow-moving crisis was characterized by the collapse of many savings and loan associations (S&Ls), which were financial institutions that primarily focused on mortgage lending.

More than one thousand S&Ls failed during this period, it was unquestionably the largest banking crisis since the Great Depression. The crisis was triggered by a combination of factors, including deregulation, poor lending practices, and an economic downturn.

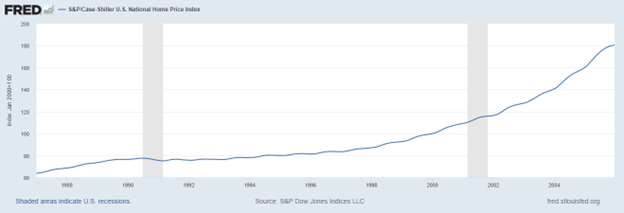

Case-Shiller Home Price Index: The Gold Standard of Home Values

The Case-Shiller Home Price Index (CSHPI) is a widely recognized measure of home values in the United States. Created by economists Karl Case and Robert Shiller, the CSHPI is based on a methodology that tracks changes in the value of residential real estate by analyzing repeat sales of single-family homes.

By measuring home price fluctuations over time, the CSHPI provides valuable insights into the health and value of the housing market.

Impact of the Savings and Loan Crisis on National Home Values

During the S&L Crisis, the housing market experienced a slowing of appreciation that turned to minor deprecation in home values in 1990 and 1991.

The CSHPI can help us better understand the effects of the crisis on national home values:

1. Slowdown in Home Price Appreciation:

In the ten years leading up to the crisis (1976 to 1985), the CSHPI revealed that national home prices appreciated a cumulative 112%. Home prices were running very hot with three double-digit appreciation years in a row in 1977, 1978, and 1979.

In the ten years DURING the crisis (1986 to 1995) home prices nationwide appreciated a cumulative 40%. This slowdown can be attributed to several factors, including rising interest rates (which increased from roughly 9% to their peak of 18.63% in 1981), economic stagnation, and the fallout from the S&L failures.

2. Rebound of Appreciation:

The CSHPI data also indicates that the housing market rebounded in the decade AFTER the S&L crisis (1996 to 2005) with cumulative appreciation of 124%. The appreciation rebound can be linked to several factors, including the resolution of the S&L Crisis, the easing of monetary policy, and a general improvement in economic conditions.

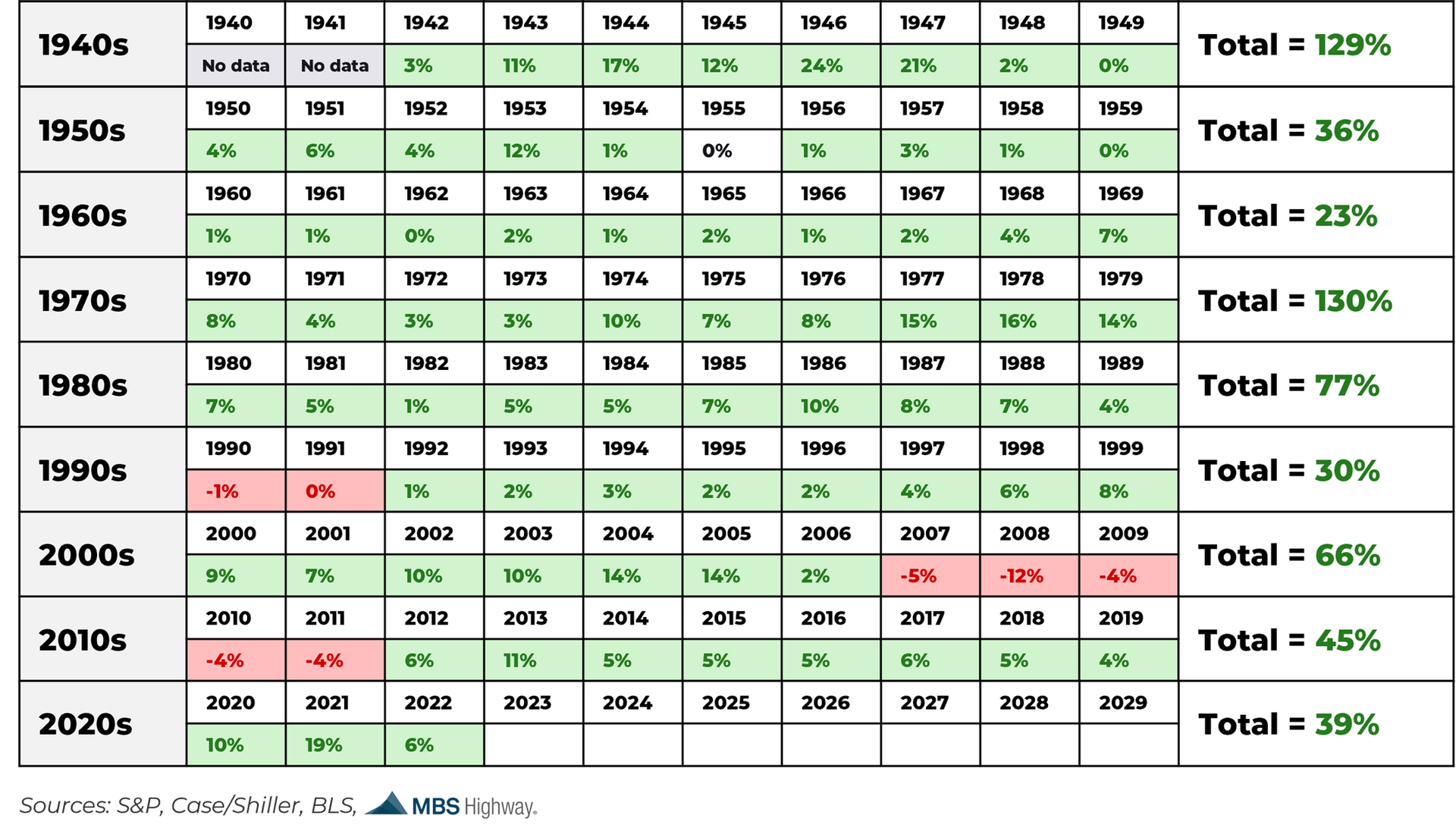

Below is a chart of national home appreciation going back to 1942. Out of the last 81 years, home values have been up 73 years (green boxes), down seven years (red boxes), and flat one year (white box). This long-term perspective teaches us two powerful lessons.

- Residential real estate has a 90%-win rate. This is better than just about any other asset class over a very long time horizon.

- Coming out of tumultuous economic times, like after the Great Depression, the S&L Crisis, and after the Great Recession, home prices rebound and do very well.

The Bottom Line

As we watch the 2023 banking crisis unfold, nobody knows for sure how contagious it will be. But as the saying goes, “History doesn’t repeat…but it often rhymes.”

With a significant housing shortage, lowering inflation and mortgage rates moving down, we don’t expect home prices nationally to decrease during the fallout. We expect low single-digit appreciation similar to the early 1990s.

According to the most recent batch of housing data, home prices are already moving higher (numbers below show increases compared to the previous month):

- CoreLogic: prices up 1.6% in March 2023

- Black Knight: prices up 0.5% in March 2023

- Zillow: prices up 0.9% in March 2023

- FHFA: prices up 0.5% in February 2023

- Case-Shiller: prices up 0.2% in February 2023

All of this goes to say, you should not be worried about buying a home in this market. If history tells us anything, it’s that housing does very well in times of economic turmoil – especially compared to other asset classes.

If you are ready to purchase a home but you have been waiting for prices to fall, now is the time to get moving. Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.