Inflation, The Fed, and Mortgage Rates - What's Going On?

The Federal Reserve announced another .25% increase to its benchmark short-term interest rate this week, following a lot of speculation after the recent turmoil in the banking industry.

Almost immediately after the Fed’s announcement, rates for a 30-year fixed-rate mortgage dropped another .25%. This combined with the drop following the banking failures to bring rates to their lowest since February.

This is welcome news for homebuyers who’ve been waiting for rates to fall after watching them creep up over the last two months. But will the trajectory continue?

Rates Will Continue to Follow Inflation

The Federal Reserve doesn’t set mortgage rates, but its actions do have an effect on them. The Fed sets the target federal funds rate, which is how much it costs banks to borrow from one another. It’s a short-term interest rate, unlike a 30-year fixed-interest rate mortgage, which is a long term loan with an interest rate that doesn’t change.

That’s why most mortgage rates tend to follow the ups and downs of the 10-year Treasury yield, which declined after the Fed’s rate hike. Treasury notes are generally considered a fixed-income (or “safe”) investment, since they’re backed by the U.S. government. Mortgage-backed securities, on the other hand, are a higher-risk investment, since they’re based on the value of home loans. When Treasury yields rise, so do mortgage rates, to compensate for the additional risk. But when Treasury yields fall, mortgage rates follow.

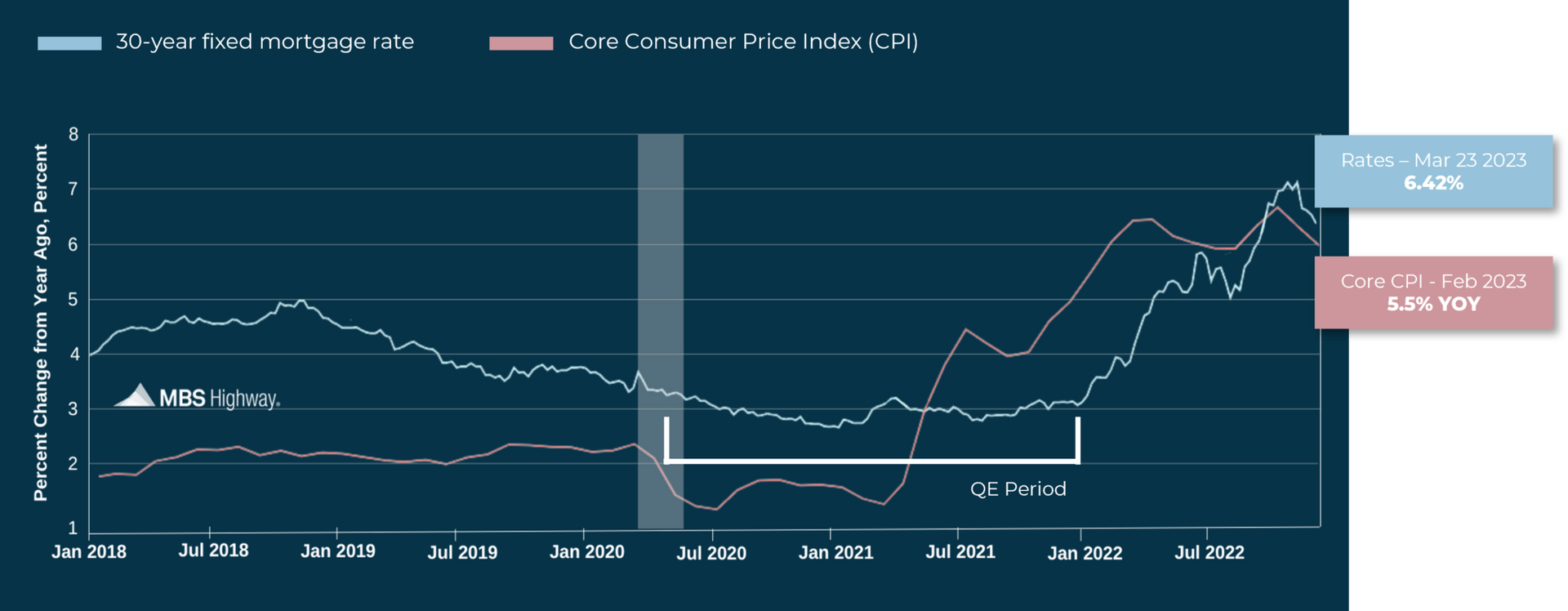

Mortgage rates also tend to rise when inflation is up, so the Fed’s monetary policy statements can have an effect on how mortgage rates trend. Rates fell following this week’s announcement because Fed Chair Jerome Powell indicated that the Fed’s starting to see traces of a softening economy.

Overall, inflation rose 0.4% in February, with the annual reading declining from 6.4% to 6.0%. Core CPI, which strips out volatile food and energy prices, increased 0.5% while the year-over-year index decreased from 5.6% to 5.5%.

One key reason inflation is still so stubbornly high is the cost of housing. According to the Bureau of Labor Statistics, shelter costs are driving more than 70% of inflation right now, but there is a lot of other data showing that rising interest rates are having an impact on the housing market, including slowing down rent increases. So why is inflation so high?

It generally takes six to 12 months or even longer for changes in rents and housing costs to show up in inflation data. Home values and rent prices didn’t really start to slow until late last year, so the inflation reading has not started taking that into account. Once the CPI numbers start taking into account the housing cost changes the we’ve seen over the last six months, inflation will start to come down more rapidly – which will bode well for mortgage rates.

Housing Always Does Well During Recessions

Everyone is confused about whether we are heading into a recession or not. Economic signals are pointing in all different directions, and with every new data release comes a new batch of headlines declaring that the odds of us heading into a recession are higher or lower than they were before.

Nobody can exactly predict when a recession will happen, but the odds are high. The entire goal of the Fed’s rate hikes is to keep money out of the economy, and since November we’ve been seeing the money supply contract for the first time since the 1990s.

Money supply growth is a a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, the money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth. The combination of the Fed rate hikes and the credit tightening in response to the recent bank failures will only continue to slow the money supply.

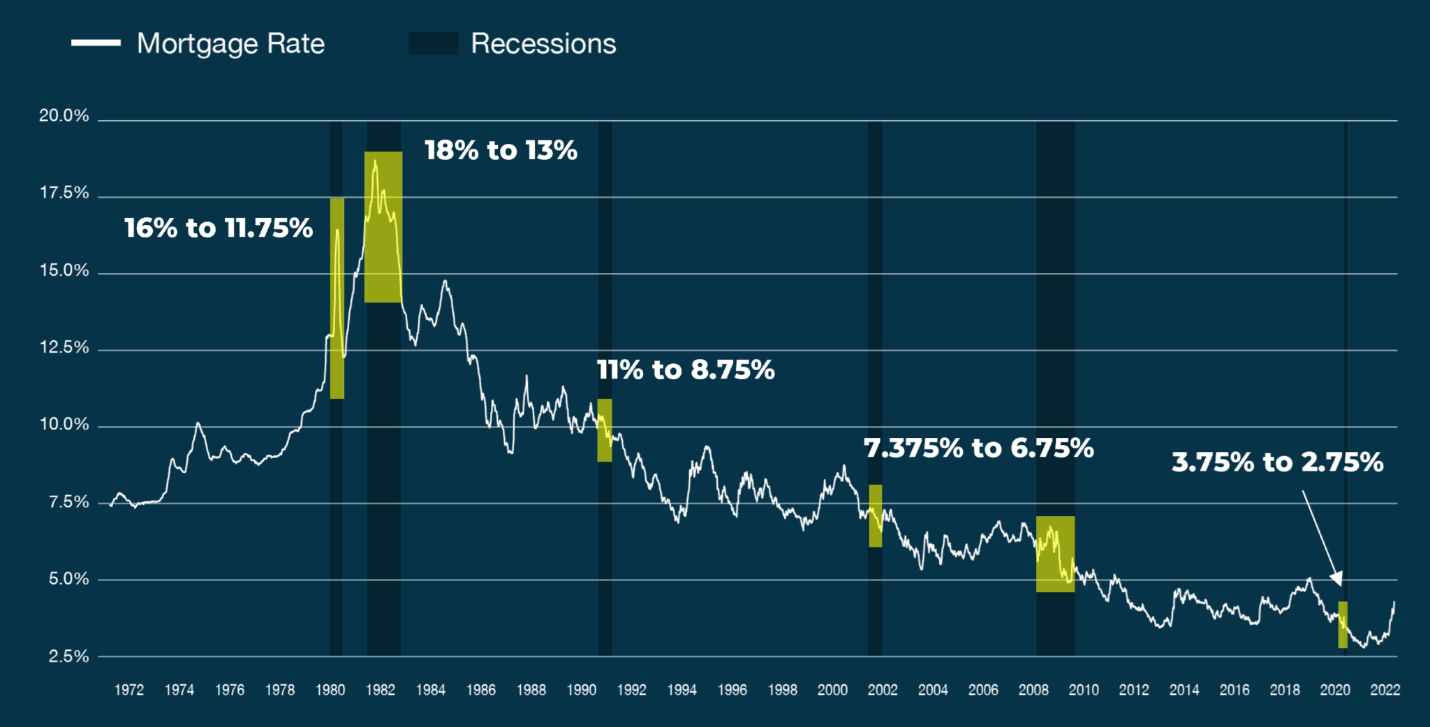

Why does this matter? Because housing always does well during recessions.

Home prices have gone up in four out of the last six recessions, and mortgage rates have decreased either during or immediately following each of those recessions.

The Bottom Line

Recession concerns, banking crises, stock market corrections, and falling inflation numbers are all at work right now to bring mortgage rates lower. Potential homebuyers could have a window of opportunity right now to lock in a lower rate or refinance a mortgage that they took out between October and November, when rates were at their peak.

Housing supply is still very low and demand is still very high. Until the supply problem is fixed, home prices will remain steady. Affordability constraints mean demand will dip slightly, but once we enter a recession and interest rates fall, demand will start to rise again.