Home Prices Rise Again and Inventory Remains Tight

Steep competition in the housing market and low supply are still heating up home prices.

On Tuesday May 30, we got the March numbers for the S&P CoreLogic Case-Shiller Indices (the index is always two months behind). It showed that home prices rose 0.4% in March after rising 0.2% in February, and they are up 0.6% year over year.

According to the index, prices have only dropped 2.3% since they peaked in June 2022. This small drop is nowhere near the doomsday results that the media has been warning of, and is only a small price correction.

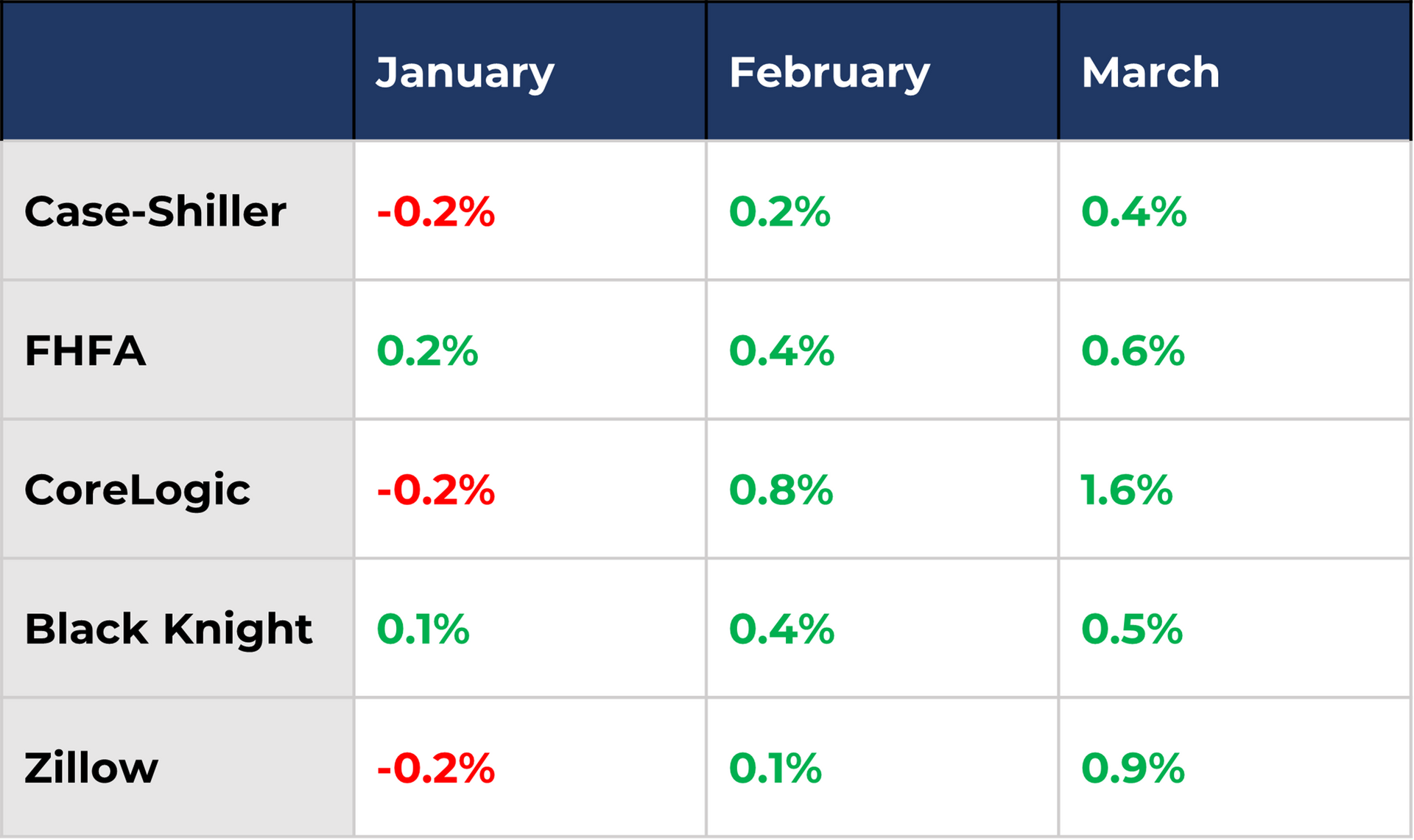

All Other Price Reports Show Positive Movement

The Federal Housing Finance Agency (FHFA) also released their housing report for Q1 of 2023 this week. Their report reported that prices rose 0.6% in March after rising 0.7% in February just 0.1% in January. What’s even more shocking is that the FHFA number show that prices are now 0.73% higher than they were at the previous peak last June!

Both the FHFA and Case-Shiller indexes use a similar methodology, but the most significant difference is that the FHFA index collects data from mortgages that have been purchased or securitized by Fannie Mae or Freddie Mac ONLY (a.k.a. conventional mortgages). It does not include data from cash purchases or non-conforming jumbo mortgages like Case-Shiller.

Homes purchased with cash typically include some price reductions, and higher-end homes purchased with jumbo loans have had more price volatility compared to conventional home purchases. This is why the Case-Shiller numbers are lower than the FHFA numbers. However, both indexes still paint a good picture of where home prices are heading, and they are not the only ones who show positive movement.

We’ve already had the March numbers from other well-known home price reports, and the FHFA and Case-Shiller reports further underline our assertion that the housing market dip is over and prices will continue to appreciate.

Our friends at MBS Highway recently brought up a good point that homebuyers should be aware of when it comes to analyzing the annual appreciation numbers. In the coming months, year-over-year appreciation will eventually turn negative as the comparisons move closer to the peak in June of last year. When this happens, the media will once again go full speed with fear-inducing headlines about a housing crash.

DON’T LET THIS FOOL YOU! Once those comparisons are past, the year-over-year appreciation numbers will bounce back very quickly. We agree with Barry Habib and the team at MBS Highway’s prediction that when all is said and done, we will see a cumulative 5-6% home appreciation in 2023.