In today's fast-paced, ever-changing real estate marketplace, moving homes without the immediate need to sell an existing residence provides an unmatched level of flexibility and strategic advantage to the process.

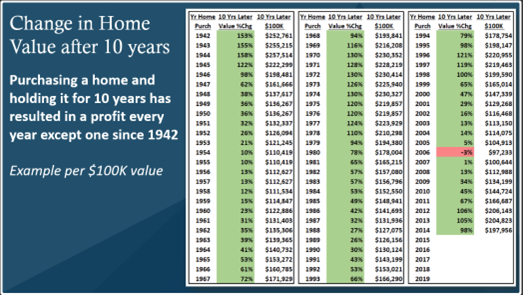

In an environment where the movement of interest rates and market dynamics is so erratic, the traditional process of buying and selling can be very intimidating. But the historical record is clear, it pays to invest in real estate. How? Well, since 1942, homeowners who have held their properties for a decade or more have never failed to realize gains on their investments in all but one period.

Despite unfavorable current interest rates and market conditions, opportunities to invest in a new home still exist. Intrinsic value and historical growth trends highlight that there are still considerable benefits to be achieved in the longer term. All in all, the best solutions to be traded are those with a good balance between low risk and high profitability.

One available solution is our Power Buyer program, which allows you to make a strong cash offer for your new property even before you sell your existing one. It increases your bargaining position, of course, but it does so much more: it takes the uncertainty out of a contingent offer, making your proposal more attractive to sellers.

Here are a few more products and programs that could help you on your financial journey:

- Home Equity Line of Credit (HELOC): Unlock the value trapped within your current home using a HELOC and secure the needed funds for down payments or home improvements to increase marketability. By using it, the only time the costs come into play is when the money is used, so it might be a wise preparatory step before the entrance into the market.

- Bridge Loans: Tailored to transition, bridge loans offer an amount equal to part of the value of the existing home as immediate cash to make it easy to purchase the new property without an urgent need to sell. No ongoing payments are required; what's more, the fee structure often undercuts traditional loan costs, buying sellers some breathing room to sell at the optimal time.

- Buy and Hold Strategy: Keep your current house as a rental property, leveraging prospective rental income for qualifying to purchase your new house. This not only maintains your investment but also taps into potential rental market gains, offering yet another avenue of income. For those with financial flexibility, retention of the existing property as a long-term investment capitalizes on market growth, diversifying your investment portfolio.

- Proof of Pending Sale: Demonstrate that your current home is under contract – this can alleviate the need to cover two mortgages, easing the financial transition between properties.

Beyond the Sale: The Long-term Vision

Considering the long-term vision, converting your current home into a rental property presents another viable option. It can be a way of putting off the decision to sell in a potentially fluctuating market, as well as initiating an opportunity for ongoing passive income coupled with long-term asset appreciation.

Your Financial Journey, Our Expert Guidance

Our role is to illuminate the best options for your unique journey, ensuring your new home meets both personal and financial aspirations. In this market landscape that keeps changing with every passing day, your decision to invest in a new home means more than just buying a place to live in. It means the first movement towards financial growth and stability.

Move a Step Ahead

We invite you to explore these innovative offerings designed for your journey. Act now for a seamless transition through the our Power Buyer program, or to capitalize on strategic rental income benefits. Connect with us to chart a course to your new home, grounded in expertise and driven by your vision for the future.

NMLS Consumer Access #150953

All Rights Reserved | Luminate Home Loans, Inc

Luminate Home Loans, Inc. a wholly owned subsidiary of Luminate Bank

NOTICE TO TEXAS CONSMERS: CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”